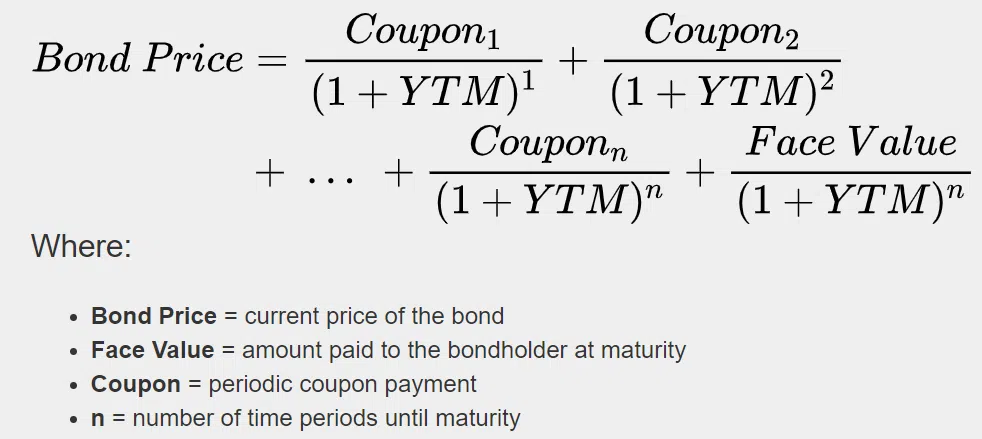

Higher Yields – The Bond issuers offer higher interest or may potentially be trading at a lower price because of which the yield you can earn on such bonds is higher than other higher rated bonds.

Shorter maturities – Typically, High Yield Bonds in India have a shorter maturity in comparison that ranges somewhere in between 1- 4 years.

A lot of these High Yield Bonds are issued by start-ups or small businesses. Since, they have limited to none borrowing history, they receive a lower credit-rating by default.Lower Credit Ratings: High Yield Bonds could range anywhere between A to BBB. Lower the rating higher is the risk on such bonds.