Explore our Featured Content

Power Finance Corporation Limited Webinar on their NCD Public Issue

+280_158.jpg)

IndiaBonds x Surat Municipal Corporation Webinar

Piramal Enterprises Ltd Webinar

IKF Finance Ltd Corporate Webinar

India's Bond Market Gaining Traction What Investors Need to Know |Vishal Goenka on Business Today TV

Stories

Go to Story

What is Sweep-in FD?

7 Pages | 49 sec

Go to Story

Post Office Fixed Deposits

9 Pages | 1 min 3 sec

Go to Story

What is Open Market Operation (OMO)?

6 Pages | 42 sec

Latest Blogs

View all Blogs

7 min read

20 Feb, 2026

Essential

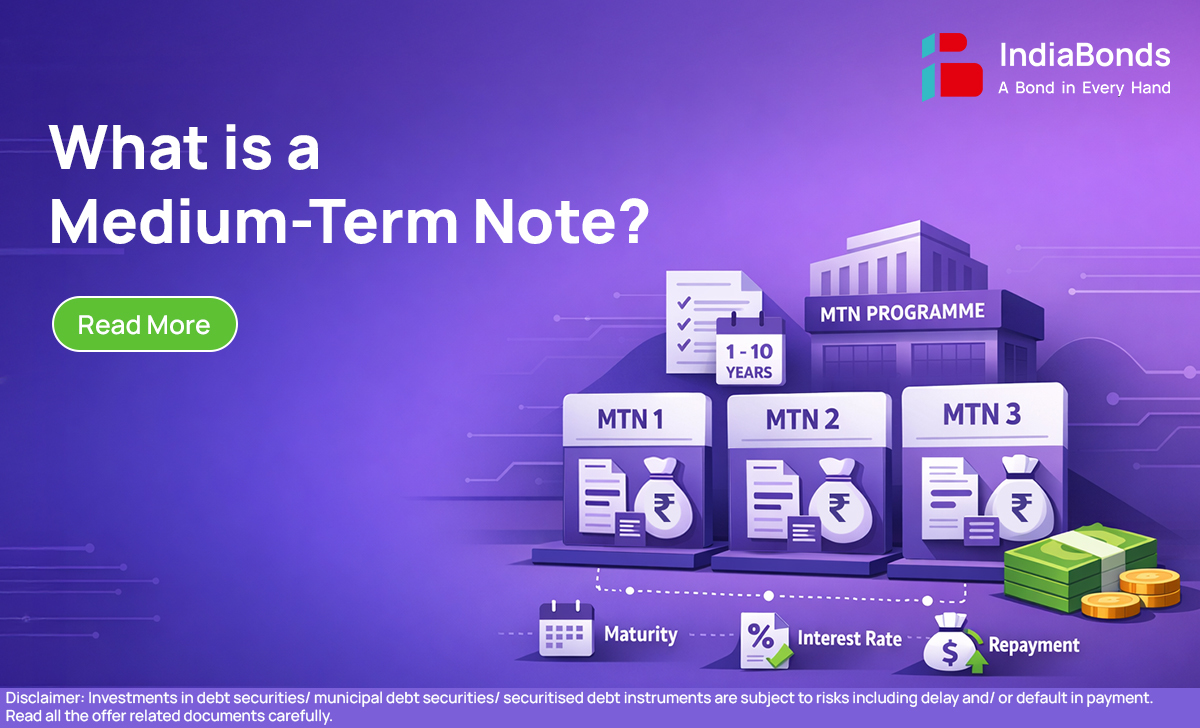

What is a Medium-Term Note

For most people, the debt market feels like a maze of similar-sounding terms. Bonds, notes, debentures—everything seems to mean “someone borrows and someone lends,” so why all the different names? The answer is simple: the market uses different formats because borrowers don’t always need money in the same way, and investors don’t always want to

8 min read

19 Feb, 2026

Essential

What is Greenshoe Option

In most large public offers, there is one line in the offer document that quietly plays a big role in keeping the listing day peaceful: the Greenshoe Option. It does not grab headlines like issue size or listing gains, but it helps the market handle big demand and sharp price swings more smoothly. What Is

10 min read

19 Feb, 2026

Essential

What is Call Option?

In equity and derivatives conversations, the term Call Option appears very frequently. For many new investors it sounds technical, even intimidating. Yet at its core, a call is simply a contract that gives someone the right to buy an asset at a fixed price in the future. Once this idea is clear, the rest of

View all Blogs

Latest Videos

View all Videos

1 min min watch

20 Feb, 2026

Education Video

Bonds - Ek Sashakt Bandhan - 2 | SEBI, NSE & BSE | IndiaBonds

Informed participation in the corporate bond market begins with clarity, diligence, and alignment with long term financial objectives. A considered approach to credit quality, tenure, and liquidity can strengthen portfolio resilience and support efficient capital allocation.

Originally published by NSE. It was unveiled during the Inaugural Pan India Outreach Program for Corporate Bonds, jointly organized by SEBI, NSE and BSE.

Bonds - Ek Sashakt Bandhan

1 min 38 sec min watch

16 Feb, 2026

Education Video

Bonds - Ek Sashakt Bandhan | SEBI, BSE & NSE | IndiaBonds

This video marks a notable moment for India’s corporate bond market. Originally published by NSE India, it was unveiled on 4 February 2026 by Shri. Tuhin Kanta Pandey, Chairman, SEBI, at the Inaugural Pan India Outreach Program for Corporate Bonds, jointly organised by NSE India and BSE India.

The focus is clear:

◦ India’s bond market is evolving rapidly.

◦ Corporate bonds are emerging as a stronger fundraising avenue for issuers.

◦ Liquidity is increasingly becoming a key consideration for investors.

At the same time, the core relevance remains unchanged. Corporate bonds help channel capital into enterprise and infrastructure, while offering defined income structures, portfolio diversification, and structured credit exposure.

As with any market linked instrument, investors should evaluate issuer strength, credit quality, and liquidity before taking an investment decision.

32 sec min watch

30 Jan, 2026

Product Video

Add Steadiness to your Portfolio | Earn 9–12%* Fixed Returns with Bonds on IndiaBonds

Diversify your portfolio today!

Earn 9–12%* fixed returns with Bonds on IndiaBonds.

🔹Zero Brokerage

🔹SEBI Registered Broker

🔹Minimum investment Rs. 10,000

Download the IndiaBonds App - https://zjnjs.app.link/indiabonds_app 📱

View all Videos

Latest Regulatory Circulars

View all Regulatory Circulars

27 Feb, 2026

Additional enhancements in RFQ platform

26 Feb, 2026

"Ease of Doing Investment (EoDI)- Disclosure of registered name and registration number by SEBI regulated entities and their agents on Social Media Platforms (SMPs)"

18 Dec, 2025

Modification in the conditions specified for reduction in denomination of debt securities

View all Regulatory Circulars

Bonds you may like...

ESAF SMALL FINANCE BANK LIMITED

Coupon

11.6500%

Maturity

Feb 2032

Rating

Type of Bond

Subordinate Debt Tier 2 - Lower

Yield

12.1613%

Price

₹ 1,01,340.55

MANBA FINANCE LIMITED

Coupon

10.9500%

Maturity

Oct 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.2500%

Price

₹ 99,924.30

NAMRA FINANCE LIMITED

Coupon

11.3500%

Maturity

Dec 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.2500%

Price

₹ 1,02,879.03

EARLYSALARY SERVICES PRIVATE LIMITED

Coupon

10.5000%

Maturity

Mar 2028

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.1500%

Price

₹ 99,705.30

EARLYSALARY SERVICES PRIVATE LIMITED

Coupon

10.7000%

Maturity

Aug 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

11.1000%

Price

₹ 1,00,152.60

KRAZYBEE SERVICES LIMITED

Coupon

10.5000%

Maturity

Dec 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

10.9000%

Price

₹ 1,00,332.70

MUTHOOT MICROFIN LIMITED

Coupon

9.9500%

Maturity

Dec 2028

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

10.8500%

Price

₹ 99,378.24

MUTHOOT MICROFIN LIMITED

Coupon

9.8500%

Maturity

Dec 2027

Rating

Type of Bond

Secured - Regular Bond/Debenture

Yield

10.7500%

Price

₹ 99,587.68

Note:

The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).

Note: The listing of products above should not be considered an endorsement or recommendation to invest. Please use your own discretion before you transact. The listed products and their price or yield are subject to availability and market cutoff times. Pursuant to the provisions of Section 193 of Income Tax Act, 1961, as amended, with effect from, 1st April 2023, TDS will be deducted @ 10% on any interest payable on any security issued by a company (i.e. securities other than securities issued by the Central Government or a State Government).