Verify Identity

Security Verification required to switch profile

Switching to profile

Please enter OTP sent on your mobile no.

Resend OTP

Please enter Date of birth

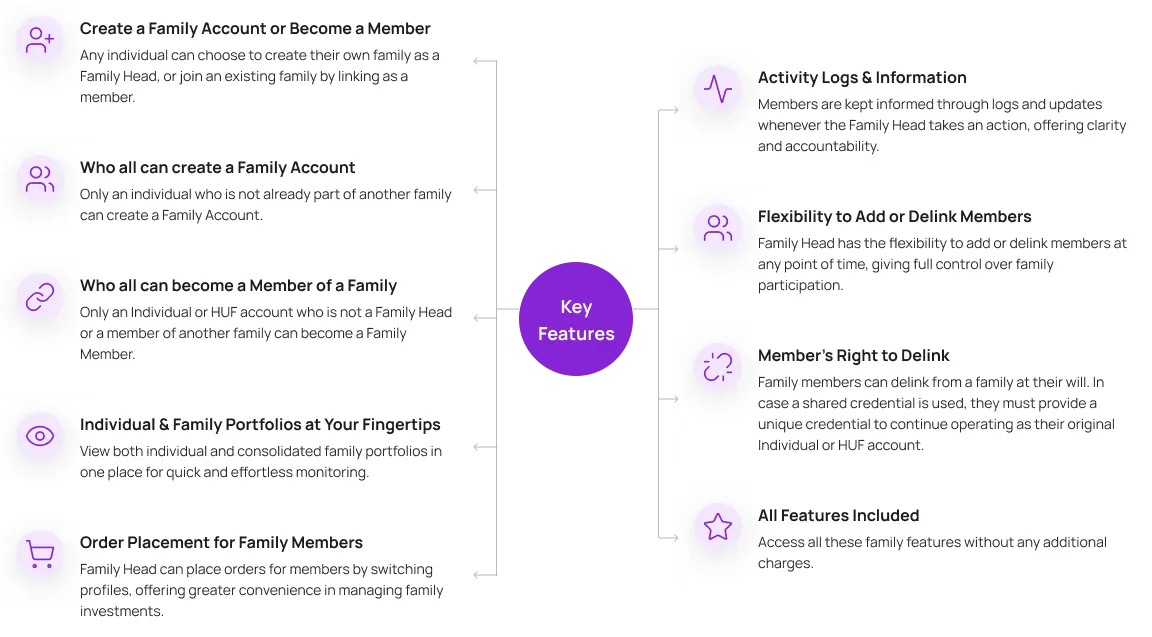

Create a Family Account or Become a Member

Any individual can choose to create their own family as a Family Head, or join an existing family by linking as a member.

Who all can create a Family Account

Only an individual who is not already part of another family can create a Family Account.

Who all can become a Member of a Family

Only an Individual or HUF account who is not a Family Head or a member of another family can become a Family Member.

Individual & Family Portfolios at Your Fingertips

View both individual and consolidated family portfolios in one place for quick and effortless monitoring.

Order Placement for Family Members

Family Head can place orders for members by switching profiles, offering greater convenience in managing family investments.

Activity Logs & Information

Members are kept informed through logs and updates whenever the Family Head takes an action, offering clarity and accountability.

Flexibility to Add or Delink Members

Family Head has the flexibility to add or delink members at any point of time, giving full control over family participation.

Member’s Right to Delink

Family members can delink from a family at their will. In case a shared credential is used, they must provide a unique credential to continue operating as their original Individual or HUF account.

All Features Included

Access all these family features without any additional charges.

Scan to Download

IndiaBonds App

Offers and Categories

INDIGRID INFRASTRUCTURE TRUST

Coupon

8.2000%

Maturity

May 2031

Rating

Type of Bond

Yield

7.6325%

Price

₹ 1,084.61

CHOLAMANDALAM INVT. AND FIN. CO.LTD

Coupon

8.4000%

Maturity

May 2028

Rating

Type of Bond

Yield

7.3542%

Price

₹ 1,083.72

GOVERNMENT OF INDIA

Coupon

6.9500%

Maturity

Dec 2061

Rating

Type of Bond

Yield

7.3087%

Price

₹ 96.38

CHOLAMANDALAM INVESTMENT AND FINANCE COMPANY LIMITED

Coupon

8.4000%

Maturity

Aug 2028

Rating

Type of Bond

Yield

7.1586%

Price

₹ 1,067.92

GOVERNMENT OF INDIA

Coupon

8.8300%

Maturity

Dec 2041

Rating

Type of Bond

Yield

6.9829%

Price

₹ 118.81

INDIGRID INFRASTRUCTURE TRUST

Coupon

8.2000%

Maturity

May 2031

Rating

Type of Bond

Yield

7.6325%

Price

₹ 1,084.61

CHOLAMANDALAM INVT. AND FIN. CO.LTD

Coupon

8.4000%

Maturity

May 2028

Rating

Type of Bond

Yield

7.3542%

Price

₹ 1,083.72

GOVERNMENT OF INDIA

Coupon

6.9500%

Maturity

Dec 2061

Rating

Type of Bond

Yield

7.3087%

Price

₹ 96.38

GOVERNMENT OF INDIA

Coupon

7.4600%

Maturity

Nov 2073

Rating

Type of Bond

Yield

7.2954%

Price

₹ 103.99

GOVERNMENT OF INDIA

Coupon

7.3400%

Maturity

Apr 2064

Rating

Type of Bond

Yield

7.2923%

Price

₹ 102.68

GOVERNMENT OF INDIA

Coupon

7.2400%

Maturity

Aug 2055

Rating

Type of Bond

Yield

7.2882%

Price

₹ 102.75

INDIAN RAILWAY FINANCE CORPORATION LIMITED

Coupon

7.2800%

Maturity

Dec 2030

Rating

Type of Bond

Yield

5.0782%

Price

₹ 1,115.08

RURAL ELECTRIFICATION CORPORATION LIMITED

Coupon

8.4600%

Maturity

Sep 2028

Rating

Type of Bond

Yield

5.0437%

Price

₹ 1,097.34

POWER FINANCE CORPORATION LIMITED

Coupon

7.3600%

Maturity

Jan 2028

Rating

Type of Bond

Yield

4.9781%

Price

₹ 1,048.62

INDIAN RAILWAY FINANCE CORPORATION LIMITED

Coupon

8.4000%

Maturity

Feb 2029

Rating

Type of Bond

Yield

4.8687%

Price

₹ 1,165.14

INDIAN RAILWAY FINANCE CORPORATION LIMITED

Coupon

7.2800%

Maturity

Dec 2030

Rating

Type of Bond

Yield

5.0782%

Price

₹ 1,115.08

RURAL ELECTRIFICATION CORPORATION LIMITED

Coupon

8.4600%

Maturity

Sep 2028

Rating

Type of Bond

Yield

5.0437%

Price

₹ 1,097.34

POWER FINANCE CORPORATION LIMITED

Coupon

7.3600%

Maturity

Jan 2028

Rating

Type of Bond

Yield

4.9781%

Price

₹ 1,048.62

INDIAN RAILWAY FINANCE CORPORATION LIMITED

Coupon

8.4000%

Maturity

Feb 2029

Rating

Type of Bond

Yield

4.8687%

Price

₹ 1,165.14