On investments in general, financial returns are expressed on per annum or per year basis. Simply put if you invest INR 100 and make INR 10 in one year, then your return is 10%. But if you make the same INR 10 in 2 years, then your return is just 10÷2 = 5%. Bonds typically have income streams spread over years. Hence, accounting for all those future cash flows post investment and expressing it as one single number for easy understanding is essential.

The most important terminology that accounts for all future cashflows in bonds and that one number is Bond Yield. Oxford Dictionary meaning of “yield” is to ‘provide or produce something’.

Hence, Bond Yield just means what a bond produces or what financial returns you get from bonds over its time period of existence.

This is expressed as a percentage. Hence, a Bond Yield of 7.5% means you earn 7.5% returns on the bond when you hold it to its maturity (also known as Yield to Maturity).

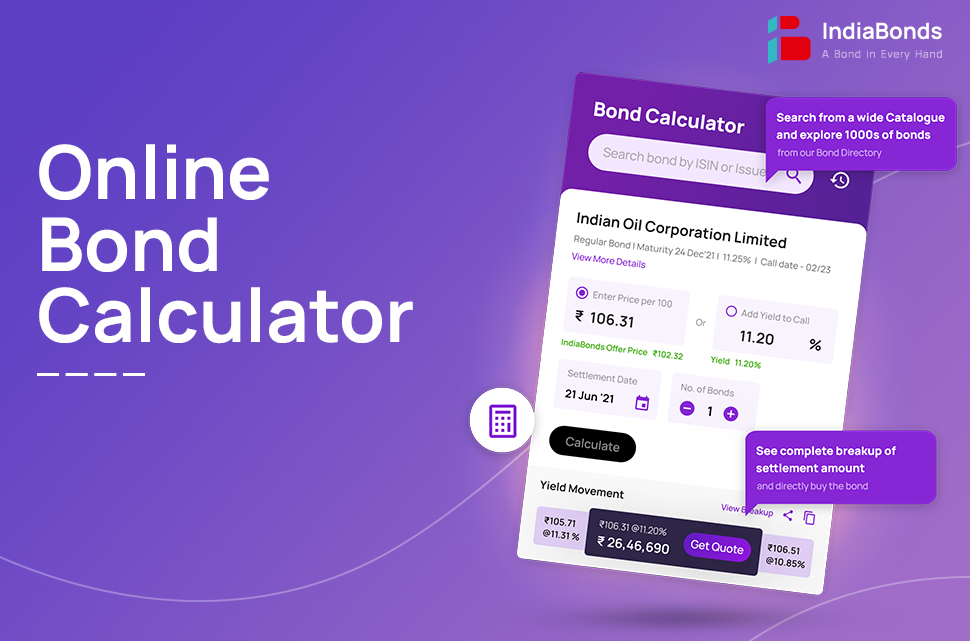

Bond Calculator is a mathematical tool that allows investors and issuers to calculate Bond Yield at a specific price or Bond Price at a desired level of yield. Calculations on bonds need various factors as input like coupon interest, coupon payment dates, maturity date, issue price, government holiday calendar for adjustments, principal repayment schedule and many more. Typically, large institutions involved in bond investments build this capability using statistical formulae, as this is their core business. For individual investors, trusts and small treasuries, it is a cumbersome task to stay on top of the thousands of bonds that are outstanding! Hence a standard Bond Calculator can assist where investors have to input all the variables to get their desired calculations.

This is an innovative solution for the needs of investors. IndiaBonds Bond Calculator helps you to calculate Bond Yield or Bond Price for thousands of bonds in India. It is a complex mathematical tool that simplifies the task for investors and institutions and gets them numerical answers instantly! All the variables and formulas are already present in this calculator hence user has to just choose the bond, input a price or desired yield and enter settlement date to get answers.

The benefits of this calculator are:

Watch the video to learn how to use Indiabonds’ Bond Calculator!

At IndiaBonds, we aim to provide investors with tools and solutions to make their investment decisions easier. True technology revolutions are about innovative ideas to make consumer activity simpler. The Online Bond Yield Calculator is one such powerful tool for bond investors all across the country. Not only is it our mission to have a Bond in Every Hand… but also a Bond Calculator in Every Hand!

Unleash the power of the online Bond Yield Calculator now and here

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.