Imagine it’s late at night, and you’re finally relaxing after a long day. As you browse through financial news, you spot a promising bond opportunity. But the market is closed, and you’re left wondering if you’ll miss out by morning. If this sounds familiar, we have great news for you! IndiaBonds is excited to announce the launch of our new feature: After Market Order (AMO). This innovative addition empowers investors to place orders outside of regular trading hours, making it easier to secure investment opportunities at their convenience.

An After Market Order allows you to place investment orders for bonds beyond regular market hours. Yes, you heard that right! You can now invest 24×7, including weekends and public holidays.

Invest 24×7: With AMO, you can place your orders at any time, whether it’s late at night, early in the morning, or during weekends and holidays. This means you no longer have to miss out on investment opportunities because of time constraints.

Avoid Missed Opportunities: Market conditions can change rapidly, and some bonds might get oversubscribed quickly. By placing an AMO, you can ensure your orders are queued up for execution when the market opens, giving you a better chance to secure your desired investments.

Extended Research Time: AMO gives you the flexibility to thoroughly research and analyze your investment options without the pressure of market hours. This can lead to more informed and strategic investment decisions.

After Market Orders are collected by the platform and executed once the market opens. Here’s a simple breakdown of the process:

Order Placement: You can place an AMO anytime outside the regular trading hours.

Payment: You make the payment straight away for your order through secure Payment Gateway (PG) and your money is held in a safe escrow account with the PG.

Market Execution: Once the market opens, the orders are executed in the sequence they were placed, subject to market conditions and availability.

Traditional market hours can be a bit of a juggle with your busy schedule. Our AMO feature lets you:

– Invest 24×7: Place orders at your convenience, anytime that suits you.

– Pre-Book Investments: Avoid missing out on great opportunities due to oversubscription.

– Extended Research Time: Make informed decisions with ample time for due diligence.

IndiaBonds has always been committed to providing a seamless and user-friendly investment experience. Here’s why our AMO feature stands out:

User-Friendly Interface: Our platform is designed to be intuitive and easy to navigate, making the process of placing AMOs straightforward and hassle-free.

Secure Transactions: We prioritize the security of your investments with robust measures in place to protect your transactions with usage of Payment Gateways

Transparency: The payment goes into an escrow account and is transferred to the clearing house on the settlement date, ensuring secure and transparent transactions.

Comprehensive Support: Our bond managers are available to assist you with any queries or issues you might encounter while using the AMO feature.

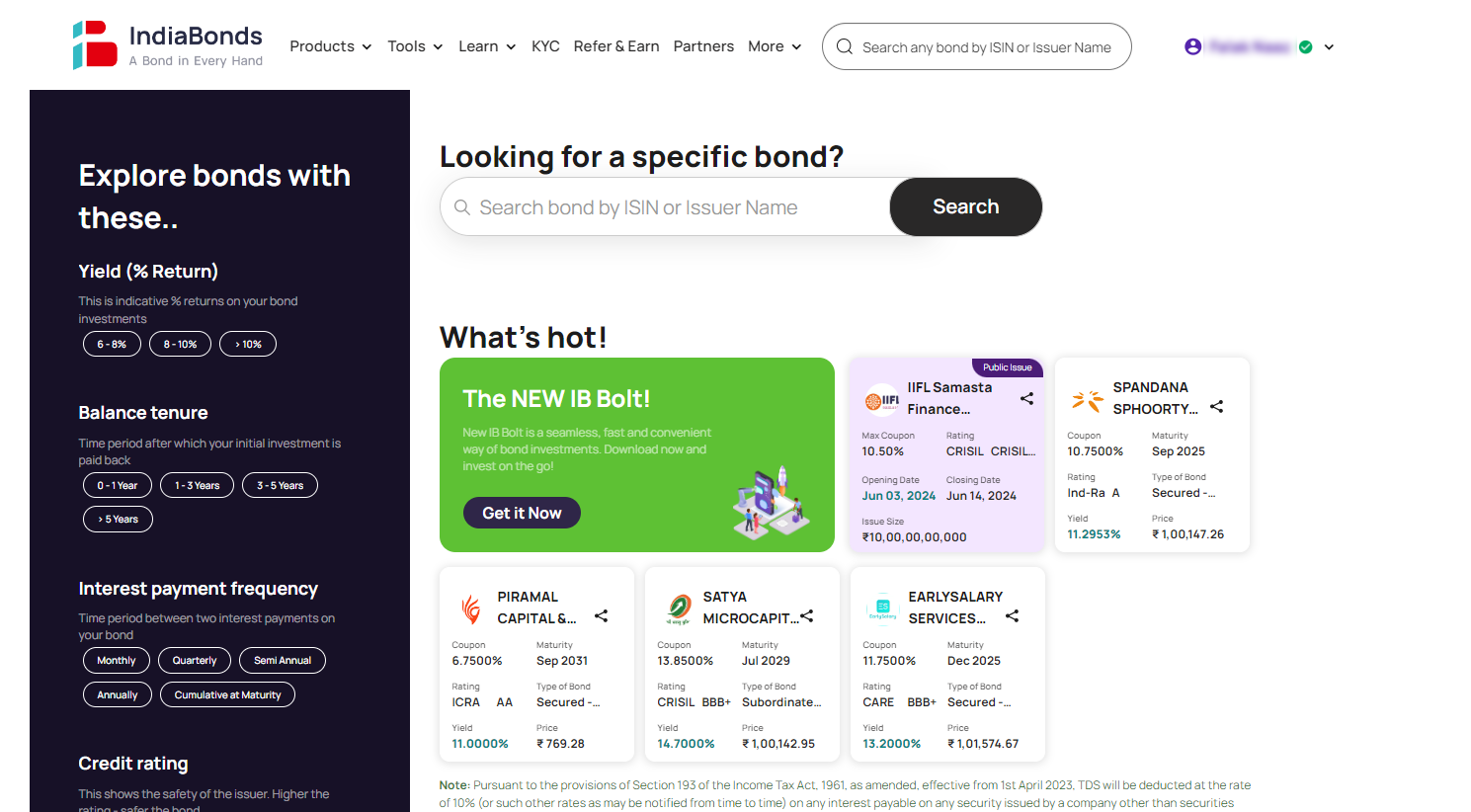

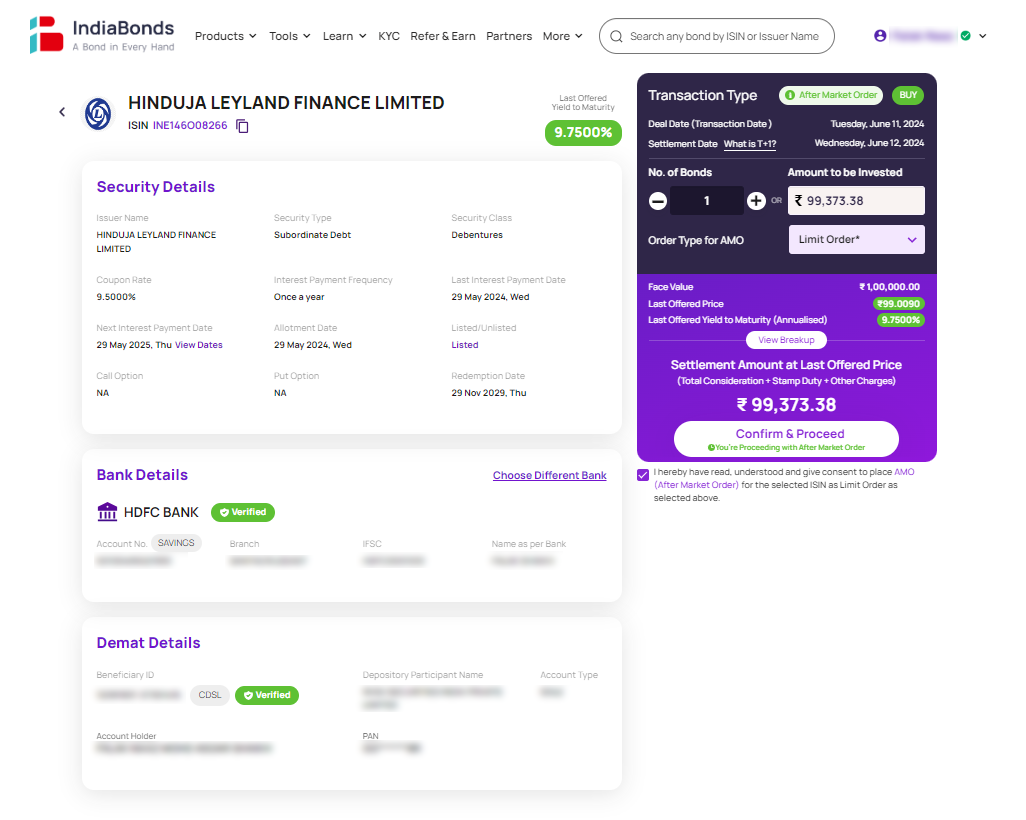

Placing an After Market Order on IndiaBonds is simple and can be done in a few steps. Here’s a walkthrough to guide you:

Log In: Sign in to your IndiaBonds account using your credentials.

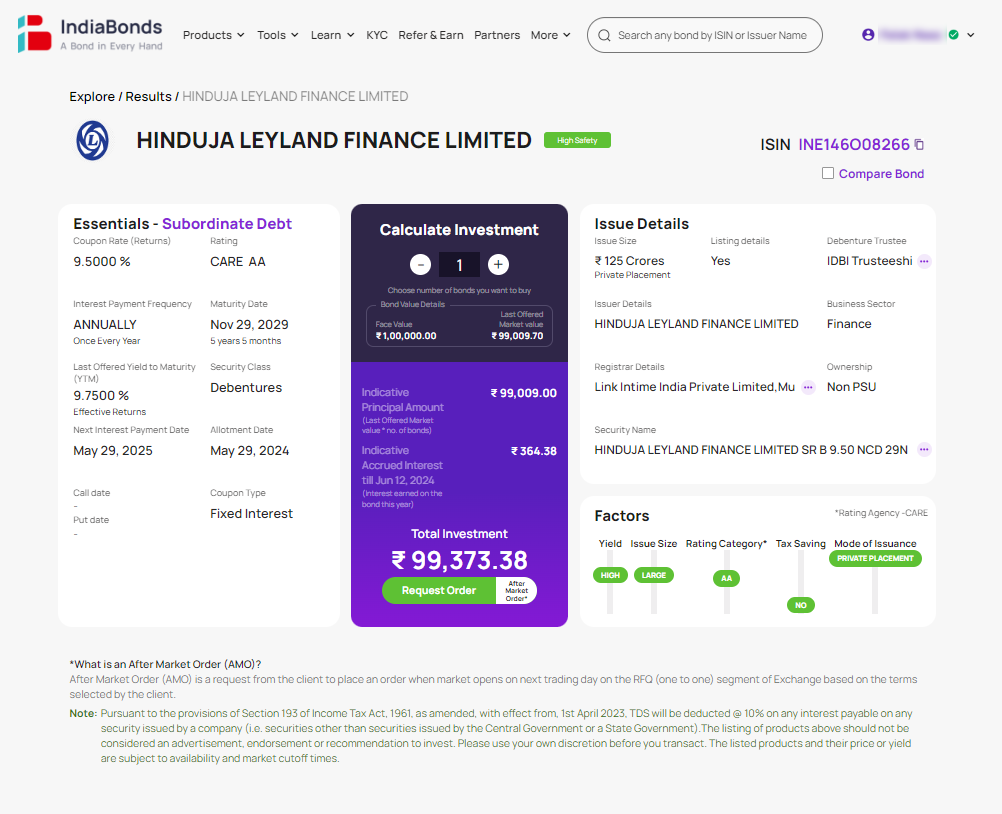

Select Investment: Navigate to the bond you wish to invest in.

Enter Order Details: Specify the quantity you want to buy or sell.

Place AMO: Click on the “After Market Order (AMO)” button.

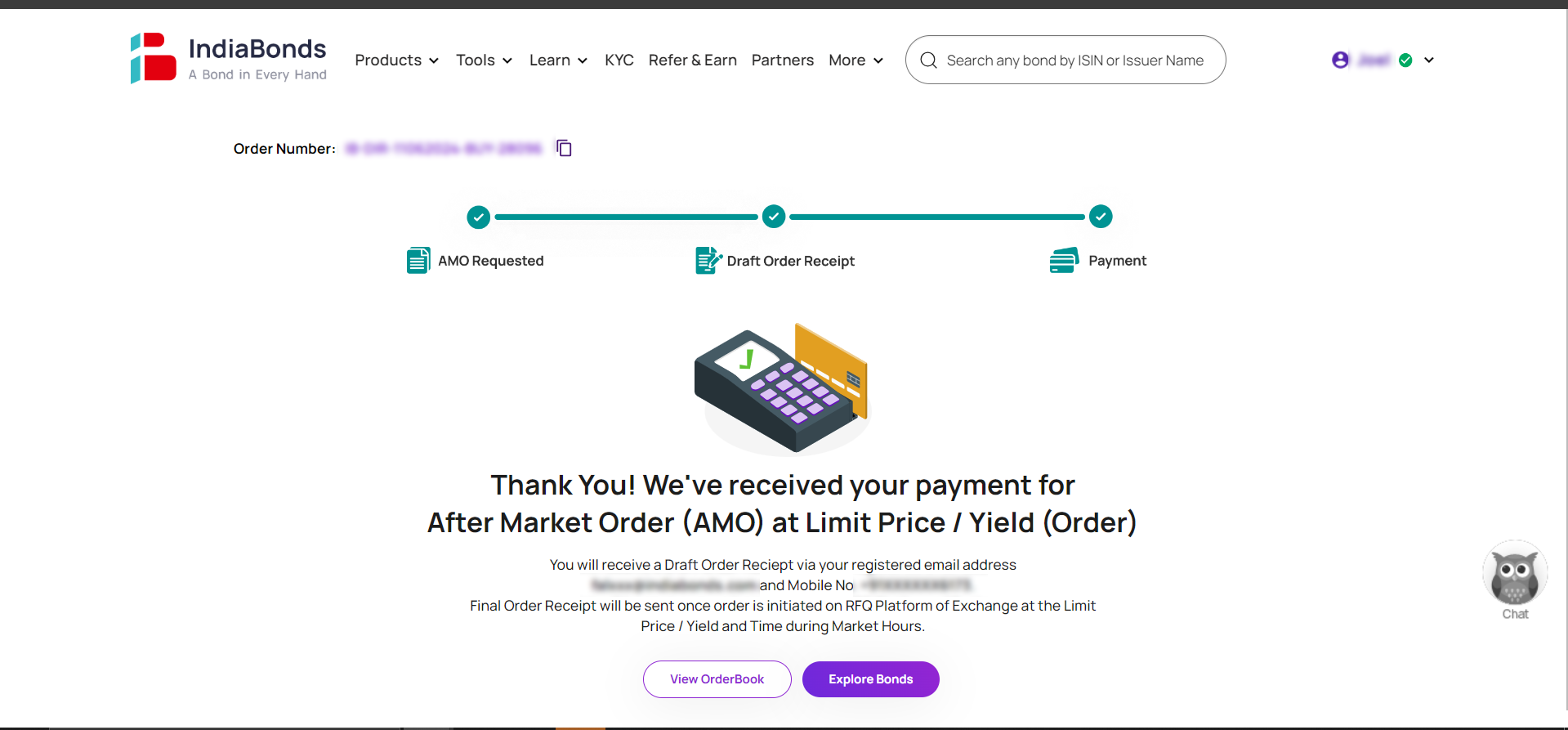

Review and Confirm: Double-check your order details and confirm the transaction. Then Review your Draft Order Receipt and make Payment through our integrated Payment Gateway = Razorpay.

After making the payment, you will receive a confirmation. That’s it, you are done!

The launch of the After Market Order feature on IndiaBonds marks a significant enhancement in our service offerings, aligning with our mission to provide flexible, secure and user-friendly bond investment solutions. We believe this feature will greatly benefit our investors by offering them the convenience and flexibility needed to make timely and informed investment decisions.

Explore the new AMO feature on IndiaBonds today and experience the ease of 24×7 investing!

A. An After Market Order (AMO) allows you to place investment orders for bonds beyond regular market hours, offering 24×7 accessibility, including weekends and public holidays.

A. Once your order is placed, there’s nothing more you need to do. Your order will be automatically queued and executed when the market opens.

A. Payment gateway’s escrow account.

A. You can cancel the order before 9.00 am the next working day. Refunds are processed as per the policy of the payment gateway.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.