54EC or Capital Gain Bonds are investments in bonds that help you save tax. Capital Gain Bonds have been designed specifically to encourage people to invest in long-term infrastructure projects led by government-owned PSUs and in return offer investors a tax saving mechanism. The name is derived from Section 54EC of the Income Tax Act of 1961, under which investors can claim tax exemption on capital gains.

Capital Gain is an economic concept defined as the profit earned on the sale of a capital asset (eg. Land/Building) that has been held over a period of time. The profit or gain arises when the sale price of the asset is higher than the purchase price and is calculated as the difference between the two. Investors must pay taxes in the year the capital asset is transferred which is called Capital Gains Tax.

Capital gains tax is applied only to profits earned from the capital asset sale, but not on inheritance or gift, regardless of the ownership transfer.

Investment in Capital Gain Bonds is for the sole purpose of reducing tax liability that arises from sale of capital assets that are immovable like Land or Building. Hence an investor need not pay capital gains tax if the gains are invested in these bonds under the following conditions:

1) Exemption is claimed only for profits from property sales comprising land and buildings, both residential and commercial

2) Investment in Capital Gain Bonds should be within six months from the capital asset sale to avail the exemption; one can check the allotment status after investing

3) The maximum exemption and investment limit is INR 50 lacs in a financial year

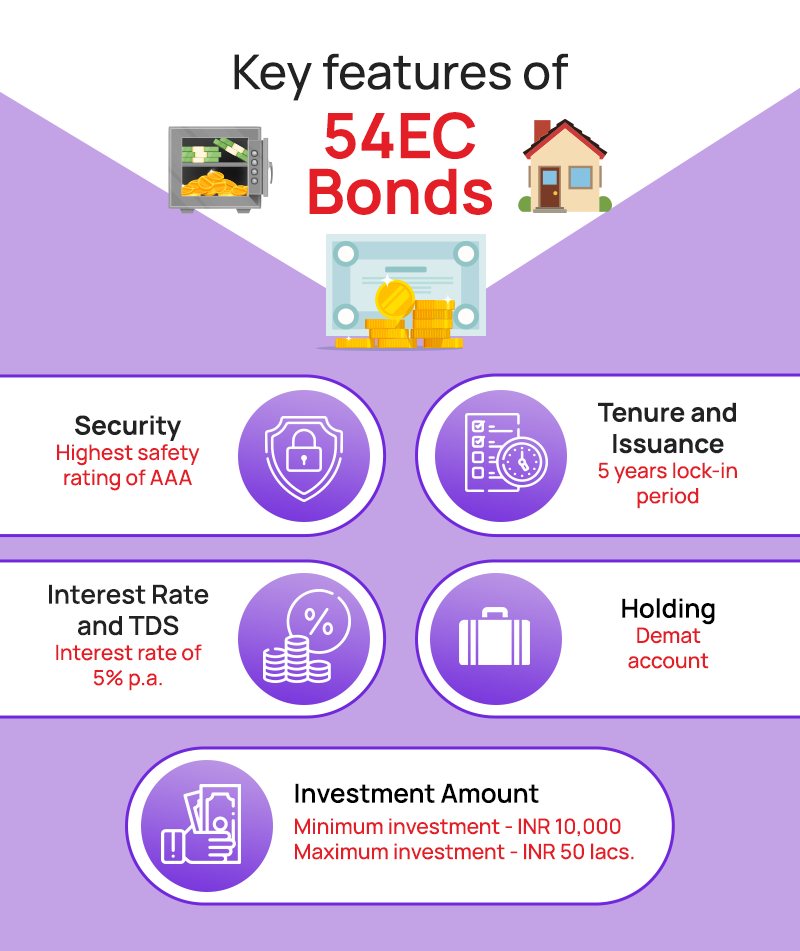

4) Investment in 54EC bonds have a lock-in of 5 years from the date of investment. Investors can’t sell or redeem the bonds for five years to avail the tax exemption

Only certain Public Sector Undertakings (PSUs) are approved by the government to issue 54EC Bonds. The benefit to investors is that these issuers are government owned hence all the bonds are rated AAA (highest safety) by credit rating agencies and carry minimal risk. The following are eligible to issue Capital Gain Bonds:

REC – Rural Electrification Corporation Limited (REC 54EC Bonds)

PFC – Power Finance Corporation Limited

IRFC – Indian Railways Finance Corporation Limited

Click here to see the entire list of 54EC bonds for investment on IndiaBonds.

In India, these bonds are a popular investment choice for mitigating long-term capital gains tax arising out of the sale of the property. Here are the main features of the bonds:

There is no TDS deduction applied on the interest rate. However, investors have to pay tax on the interest as per their own applicable slab rate under interest income for that year.

Investment Amount– Minimum investment in Capital Gain Bonds is 1 bond for INR 10,000 with a maximum limit in a financial year of up to 500 bonds for INR 50 lacs.

Holding– These bonds can be held easily in your Demat account or in physical form. We always recommend investors hold securities in Demat accounts given higher safety and convenience!

This is where IndiaBonds makes it extremely simple for you. We believe that investors in India and an NRI should have access to transparent pricing, information at hand, and the guidance of experts if required. You can invest online by yourself in 54EC Bonds

If you are unsure of where to begin, contact us, and one of our bond managers will get back to you shortly and guide you through the process.

In this digital age, it is time to explore investment options and buy bonds online from the comfort of your home in India!

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.