#Advanced

Bond Valuation

Introduction What comes to your mind when you hear the term ‘bond valuation’, do you immediately think of complex mathematical calculations or mind-boggling fixed-income concepts? When it comes to fixed-income securities or financial investments in general, we tend to shy away from concepts and strategies because they can be difficult to comprehend and what we […]

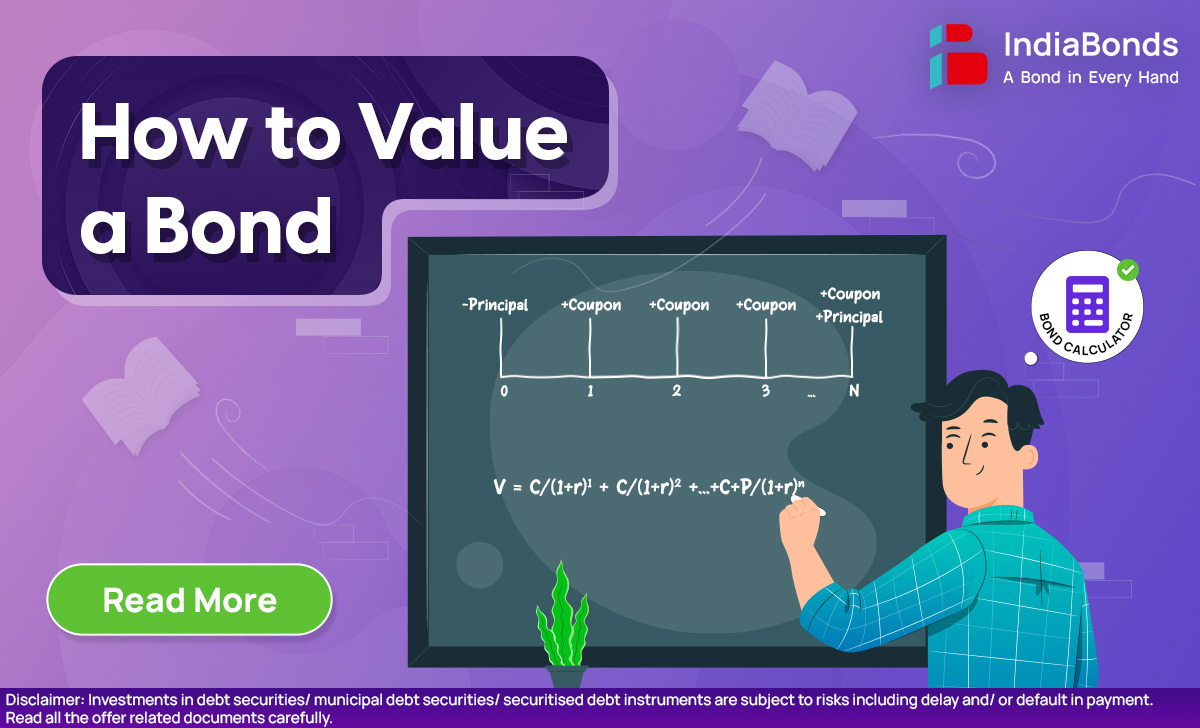

How To Value A Bond

Introduction In our earlier write-up about bond valuation, we addressed how the concept of time value of money plays a big role in figuring out what an asset is truly worth before you decide to invest. Now, let’s take it a step further. I really recommend giving the first part a read if you haven’t […]

Interest Rate Swaps 101 – Understanding the Basics and How They Work

Sid and Sunil are comic book aficionados. Sid has a majority collection of Archie’s, while Sunil has a collection of Tinkle and Tintin books. One day, they decide to engage in a swap. Sunil gets the opportunity to read Sid’s Archie collections, while Sid can enjoy reading Sunil’s Tinkle comics. It’s a mutually beneficial arrangement […]

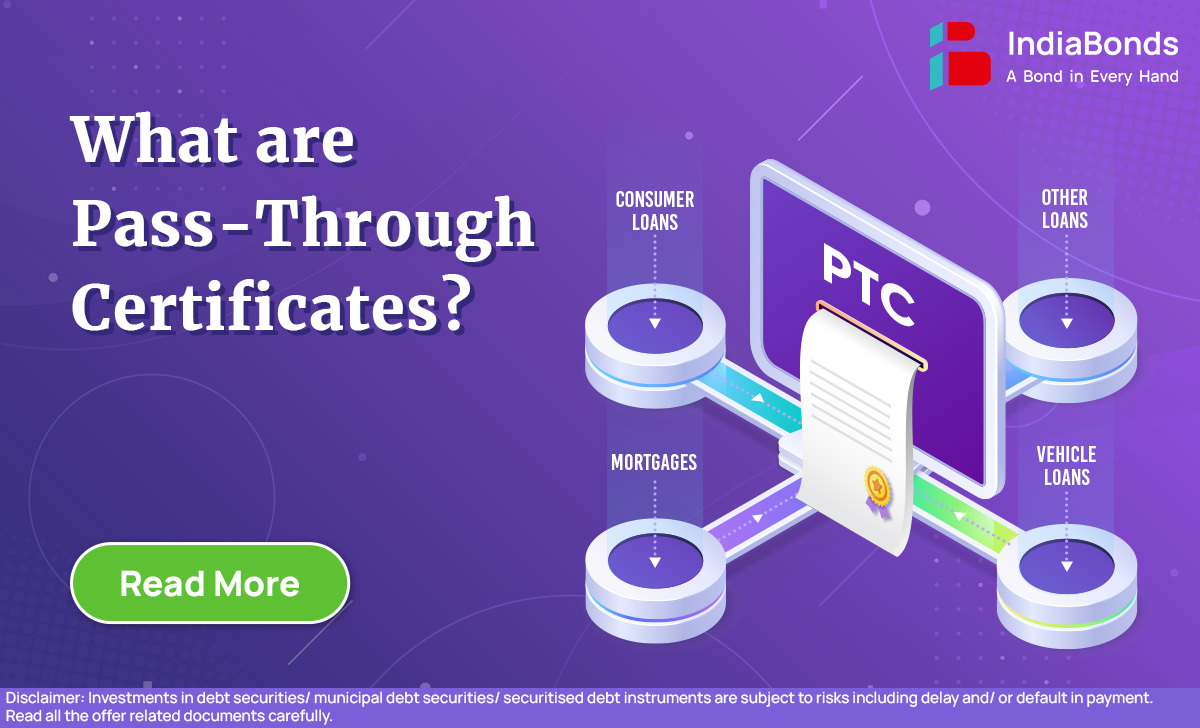

What are Pass-Through Certificates (PTCs)?

Introduction Financial engineering has become a powerful mechanism in structured finance, to bridge liquidity gaps, restructure risk, and create marketable securities from previously illiquid assets. While the intent behind financial innovations was to create value, they’ve also been at the center of significant misuse, particularly during the Global Financial Crisis (GFC) of 2008. The global […]

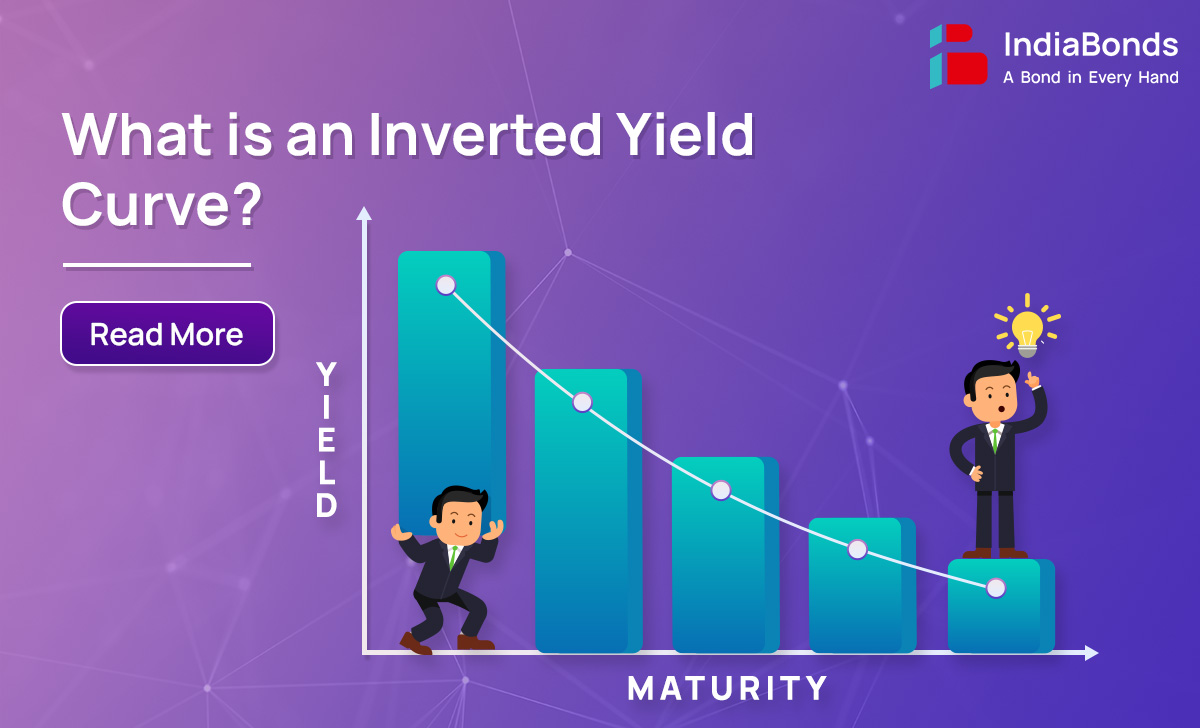

What is the Inverted Yield Curve and why it matters

In the world of bond investing, the term “yield” is synonymous with “return.” When referring to the “yield” of a 10-year Government Security (G-Sec), it communicates the 10-year return on that particular bond. The yield curve is a graph that shows the relationship between the yields and the maturity dates of a series of bonds. […]