Bengaluru is known for its delightful weather, notorious traffic, vibrant nightlife and its delightfully far distance from the city to the airport! Beyond these features, Bengaluru is also celebrated for its IT hubs, affectionately known as ‘tech parks’. Among these hubs stands Embassy Manyata, fondly known as “Manyata Tech Park”. Covering 120 acres and offering approximately 16 million square feet of office space, it hosts some of the world’s most prominent companies and boasts a bustling community of over 100,000 employees. The park boasts amenities like hotels, sports facilities, and food courts. Embassy Manyata’s expansive scale commands attention, comparable to renowned business districts like London’s Canary Wharf and a significant portion of Singapore’s CBD. Over the next few years, Embassy REIT plans to add another 3.2 million square feet to the park, further enhancing and reinforcing Embassy Manyata’s position as a premier business destination in Bengaluru. Now, imagine yourself being a part of this growth opportunity. Embassy Manyata is owned and managed by Embassy REIT, which is a Real Estate Investment Trust. Notably, it was India’s first publicly listed Real Estate Investment Trust.

If you’re looking to diversify your portfolio and explore opportunities beyond traditional real estate investing, then REIT might just be what you need. In this article, we will dive into the world of REITs; explore their features, as well as their respective advantages and risks.

A Real Estate Investment Trust (REIT) is an investment trust that allows investors to pool their funds and invest in various real estate projects. Essentially, it functions like a mutual fund for real estate investments. These trusts own and oversee a portfolio of income-generating properties, such as office buildings, hotels, and shopping malls, etc. When investors invest in a REIT, they become fractional owners of the property equivalent to the amount they’ve invested, giving them access to the benefits of owning real estate assets in small ticket sizes. REITs in India are currently in a nascent stage compared to the global REIT market. Introduced in America in 1960, according to the National Association of Real Estate Investment Trusts (Nareit), approximately 170 million Americans own REITs through their retirement savings and other investment funds. U.S. REITs possess more than $4 trillion in gross real estate, with public REITs holding $2.5 trillion in assets. U.S. listed REITs have an equity market capitalization of over $1.4 trillion.

In India, REITs were introduced in 2014 and they hold immense potential due to their low correlation to other asset classes, the size of the Indian workspace market, and the insatiable thirst of Indian investors for real estate investments. Currently, there are 5 REITs registered with SEBI, Embassy Office Parks REIT, Mindspace Business Parks REIT, Nexus Select Trust, Brookfield India Real Estate Trust and 360 One Real Estate Investment Trust.

1. REITs are required to allocate 80% of their assets to completed properties to generate steady income. The remaining 20% can be allocated to potential growth opportunities, including under-construction projects, listed or unlisted debt of real estate companies, government securities, money market instruments, or cash equivalents.

2. REITs distribute 90% of Net Distributable Cash Flow (NDCF) among unit holders as dividends or interest.

3. REITs are regulated by SEBI and are listed on exchanges thereby offering liquidity and trading convenience.

4. REITs cannot invest in agriculture land, vacant land.

5. REITs must have minimum asset size of Rs 500 crore.

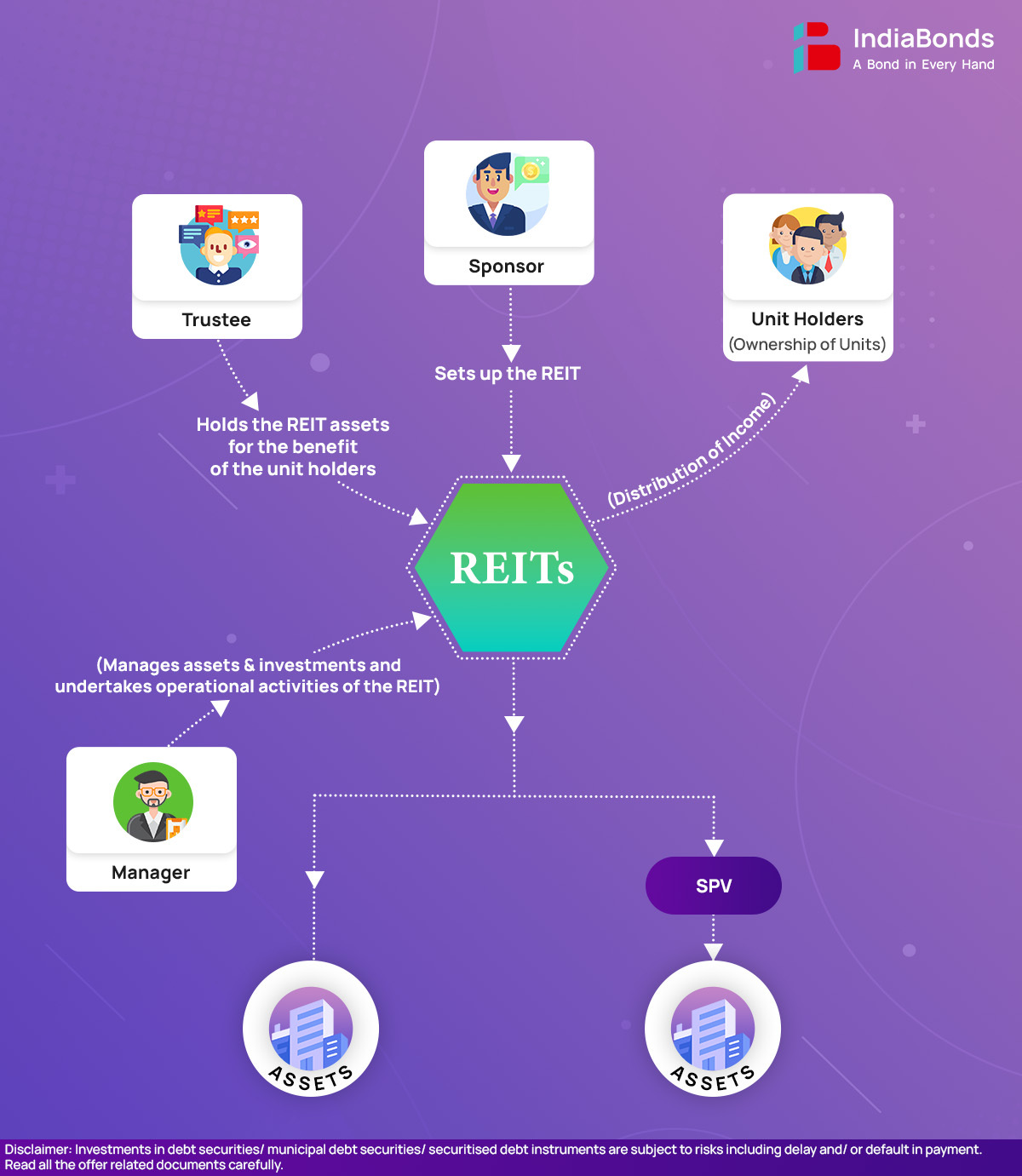

Sponsor and REIT Formation: The sponsor is the entity that initiates the creation of the REIT and appointing the trustee. Sponsors must contribute at least 25% of the value of the REIT at the time of initial offer and are required to maintain this minimum contribution for at least 3 years post-listing.

Special Purpose Vehicle (SPV) and Property Acquisition: The SPV is a separate legal entity created to hold the real estate assets. It is typically formed by the sponsor to acquire and manage the properties. If an SPV is used, it acquires properties which are then leased out to generate rental income. This structure can help in isolating financial and legal risks associated with individual properties.

REIT Manager’s Role: The REIT manager, who is often the same entity as the property manager, oversees the overall operations of the REIT. This includes strategic decisions regarding property acquisitions, leasing strategies, and asset management. The manager is appointed by the trustee and is tasked with maximizing the value of the trust through effective asset management.

Trustee’s Role: The trustee holds the legal title to the REIT’s assets on behalf of the unit holders and ensures compliance with regulatory requirements and the REIT’s governing documents.

Unit holders: Unit holders are investors who purchase units of the REIT. By doing so, they become partial owners of the underlying real estate portfolio. REITs must distribute at least 90% of their net taxable income to their unit holders.

REITs generate returns for investors primarily through two channels: Income distributions (dividend and interest) and capital appreciation. Here’s how each of these works:

Income Distributions (Dividend and Interest): These payouts are made from the operating income of the assets, after deducting expenses related to the management and maintenance of the facilities. They are typically distributed quarterly.

Capital Appreciation: REITs are traded on stock exchanges, meaning that the price of individual units can vary. Over time, the price of REITs may increase, subject to good performance and market demand, potentially providing capital gains to investors.

Access to Institutional-Grade Assets: REITs provide retail investors with access to high-quality, income-generating assets that were previously only available to institutional investors. This access allows investors to participate in real estate sectors with relatively lower investment amounts.

Portfolio Diversification: Investing in REITs enables diversification beyond traditional asset classes. This diversification helps in reducing overall investment risk by spreading exposure across different sectors and asset types.

Income Stability: REITs generate income through dividends or interest from their underlying assets. This stream of cash flows provides investors with an income source, potentially supplementing other investment returns. The stability and predictability of these payments depend on the cash flows generated by the REIT assets.

Potential for Capital Appreciation: Apart from income, investors may benefit from capital appreciation if the value of the underlying assets increases over time. This potential for capital appreciation enhances the overall return potential of investments in REITs.

Transparency and Information Availability: REITs typically provide transparency regarding tenant profiles, occupancy levels, and average rents of the properties they own. Additionally, they are required to make timely disclosures under SEBI regulations. This transparency assists investors in making informed investment decisions by providing detailed information about the underlying assets.

Work-From-Home (WFH) Impact: The rise of remote work due to factors such as the COVID-19 pandemic could affect the demand for office spaces, potentially impacting the rental incomes of REITs owning commercial properties.

Limited liquidity: Despite being listed on stock markets, REITs have fewer retail investors, making it challenging to sell investments profitably, especially in emergencies, resulting in low liquidity.

Investing in Real Estate Investment Trusts (REITs) in India is open to all types of investors, including domestic, foreign, retail, and institutional. As of July 30, 2021, the minimum subscription amount for REIT units ranges from ₹10,000 to ₹15,000, with a trading lot of 1 unit. Investors can purchase REIT units through a Demat account, similar to how they would buy equity shares. There are two primary ways to own REIT units: by subscribing to the issue in the IPO, or by purchasing units from the Stock Exchange where they are listed.

Real Estate Investment Trusts (REITs) come in a few distinct types, each offering a unique way to invest in real estate:

Equity REITs: These REITs own and operate income-generating properties, giving investors a share of rental profits from assets like shopping centers, apartments, and offices.

Mortgage REITs: Instead of buying properties, Mortgage REITs finance them. They earn income through interest on real estate loans, catering to those seeking steady returns from property debt.

Hybrid REITs: Combining elements of both Equity and Mortgage REITs, Hybrid REITs offer a mix of rental income and mortgage interest, appealing to investors who want a balance.

Private REITs: These REITs are not publicly traded and are generally accessible only to institutional or accredited investors, offering an alternative path to real estate exposure.

Publicly Traded REITs: Listed on major stock exchanges, these REITs are easy to buy and sell, providing the liquidity and accessibility of traditional stocks.

Public Non-Traded REITs: Though registered with regulators, these REITs aren’t traded on exchanges. They can offer stable income potential with fewer price swings, but they’re less liquid.

Each type has a unique role, so choosing the right REIT depends on your goals, whether it’s regular income, property appreciation, or a specific balance of risk and return.

In India, for a company to qualify as a Real Estate Investment Trust (REIT), it must meet SEBI’s standards, ensuring a trustworthy and transparent investment for individuals. Here’s a straightforward look at what qualifies a company as a REIT:

Registered as a Trust: A REIT must first be structured as a trust under the Indian Trusts Act and registered with SEBI. This regulatory oversight reassures investors that the REIT is following India’s strict standards.

Asset Allocation in Completed Properties: At least 80% of a REIT’s assets must be in completed, income-generating properties, typically commercial spaces. This allocation ensures that investors benefit from steady rental income, a major appeal of REITs.

Regular Income for Investors: SEBI mandates that REITs distribute at least 90% of their net distributable income to unitholders, offering a reliable income stream and making REITs an attractive investment for those looking for steady cash flow.

Controlled Exposure to New Developments: To limit risk, only 10% of a REIT’s assets can go toward under-construction projects, maintaining a balanced portfolio with minimal speculative exposure.

Transparent Valuation and Skilled Management: REIT assets are independently valued twice a year, keeping unitholders up-to-date on their investments’ worth. Additionally, SEBI requires REITs to appoint an experienced manager and an independent trustee, ensuring competent and accountable management.

These requirements position REITs as a secure way for individuals to invest in real estate without owning property directly, making it easier to access the benefits of the real estate market with professional management and regulatory safeguards. (Source: SEBI)

| Aspect | REITs | InvITs |

| Asset Focus | Real Estate Properties (Office buildings, malls, etc.) | Infrastructure Assets (Roads, power transmission lines, etc.) |

| Regulation | SEBI (REIT) Regulations, 2014 | SEBI (Infrastructure Investment Trusts) Regulations, 2014 |

| Liquidity | Medium | Medium |

| Risk Profile | Fewer political and regulatory risks. | May carry risks due to project execution and regulatory factors |

| Minimum Ticket Size | Earlier Rs 50,000. Now between Rs 10,000-Rs 15,000 | Earlier Rs 1,00,000. Now between Rs 10,000-Rs 15,000 |

To read more about InvIT, click here.

REITs have emerged as appealing investment avenues for individuals seeking exposure to real estate, benefiting from the liquidity and transparency akin to the stock market. According to data compiled by Prime Database.com, in 2023, REITs and InvITs collectively raised ₹11,474 crore, marking a notable increase from the record low of ₹1,166 crore raised in 2022. The introduction of the SEBI regulations for Small and Medium Real Estate Investment Trusts (SM REITs) marks a significant step towards democratizing real estate investment in India. Effective from March 2024, these regulations are designed to lower the entry barriers for investors, making real estate investment more accessible and transparent. With careful consideration and prudent investment decisions, REITs can significantly contribute to helping investors achieve their long-term financial aspirations while simultaneously participating in India’s growth trajectory.

A. REITs in India are entities that own and manage income-generating real estate properties. They are similar to mutual funds but specifically for real estate. Investors can buy units of REITs which are listed on stock exchanges, providing a way to invest in real estate without buying the property directly.

A. While REITs provide a way to earn from real estate investments without owning physical properties, they carry risks such as market volatility, changes in interest rates, and variations in rental income due to economic conditions. The performance of REITs is closely tied to the real estate market, which can fluctuate based on local and global economic factors.

A. While REITs and InvITs offer several advantages, they may not be suitable for all investors. It’s essential to assess your risk tolerance, investment goals, and financial situation before investing in these trusts.

A. Returns from REITs are taxed according to the nature of income (interest, dividend, capital gains) at applicable rates. It’s advisable to consult a tax advisor for detailed implications.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.