The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from April 3-6, 2023.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today decided to:

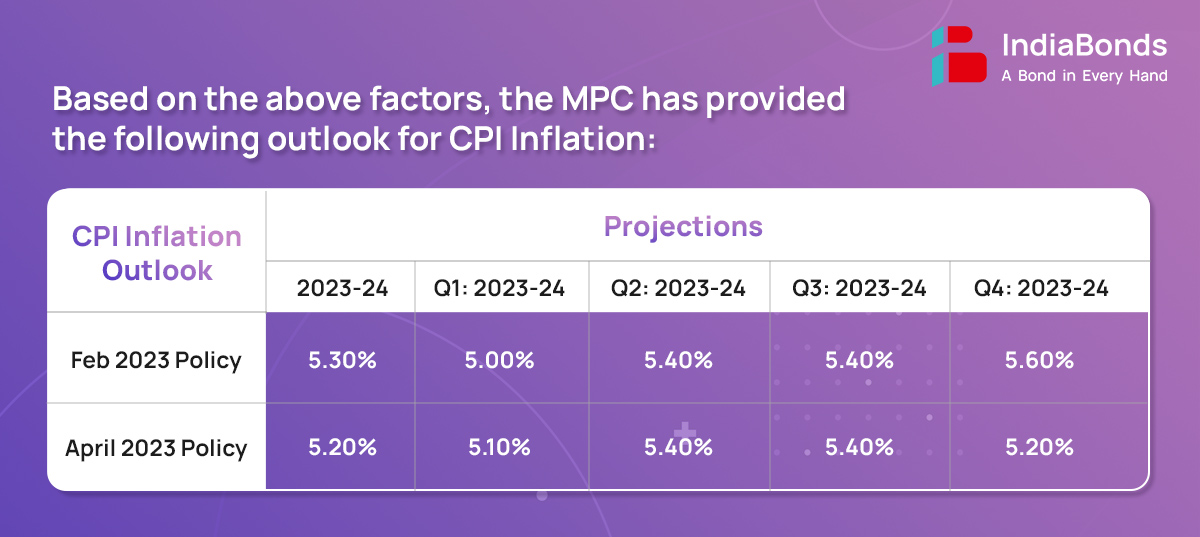

CPI headline inflation rose from 5.7% in December 2022 to 6.4% in February 2023 on the back of higher inflation in cereals, milk and fruits and slower deflation in vegetables prices. Fuel inflation remained elevated, though some softening was witnessed in February due to a fall in kerosene (PDS) prices and favorable base effects. Core inflation (i.e., CPI excluding food and fuel) remained elevated and was above 6% in January’23-February’23. The moderation observed in inflation in clothing and footwear, and transportation and communication was largely offset by a pick-up in inflation in personal care and effects and housing.

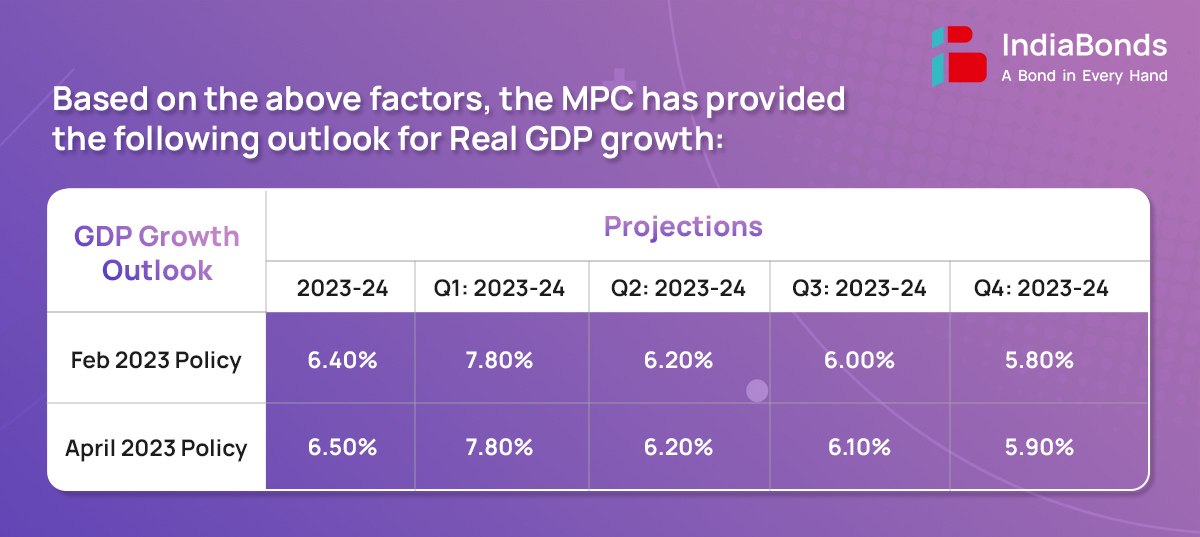

Domestic Economic activity remained resilient in Q4. Rabi food grains production is expected to increase by 6.20% in 2022-23. The index of industrial production (IIP) expanded by 5.20% in January 2023 while the output of eight core industries rose even faster by 8.90% in January 2023 and 6.0% in February 2023, indicative of the strength of industrial activity. In the services sector, domestic air passenger traffic, port freight traffic, e-way bills and toll collections posted healthy growth in Q4, while railway freight traffic registered a modest growth. Purchasing managers’ indices pointed towards sustained expansion in both manufacturing and services in March.

Global economic activity remains resilient amidst the persistence of inflation at elevated levels, turmoil in the banking system in some advanced economies, tight financial conditions and lingering geopolitical hostilities. Recent financial stability concerns have triggered risk aversion, flights to safety and heightened financial market volatility. Sovereign bond yields fell steeply in March on safe haven demand, reversing the sharp increase in February 2023 over aggressive monetary stances and communication. Equity markets have declined since the last MPC meeting and the US dollar has pared its gains. Weakening external demand, spillovers from the banking crisis in some AEs, volatile capital flows and debt distress in certain vulnerable economies weigh on growth prospects.

Banks in India which operate International Financial Services Centre (IFSC) Banking Units (IBUs) were permitted to transact in INR Non-deliverable foreign exchange derivative contracts (NDDCs) with non-residents and with each other with effect from June 1, 2020. It has been decided to permit banks with IBUs to offer INR NDDCs to resident users in the onshore market. These banks will have the flexibility of settling their NDDC transactions with non- residents and with each other in foreign currency or in INR while transactions with residents will be mandatorily settled in INR.

The application and approval processes for various entities are required to obtain license / authorization to carry out activities regulated by RBI. In the Union Budget for 2023-24 has announced the need to simplify, ease and reduce cost of compliance by financial sector regulators within laid down time limits to decide the applications under various regulations. It has, therefore, been decided to develop a secured web based centralized portal named as ‘PRAVAAH’ (Platform for Regulatory Application, Validation And Authorizations) which will gradually extend to all types of applications made to RBI across all functions.

The deposits remaining unclaimed for 10 years in a bank are transferred to the “Depositor Education and Awareness” (DEA) Fund maintained by the Reserve Bank of India. RBI has been taking various measures to ensure that newer deposits do not turn unclaimed and existing unclaimed deposits are returned to the rightful owners or beneficiaries after following due procedure. On the second aspect, banks display the list of unclaimed deposits on their website. RBI has decided to develop a web portal to enable search across multiple banks for possible unclaimed deposits based on user inputs. The search results will be enhanced by use of certain AI tools.

Increase in customer complaints regarding credit information reporting and the functioning of credit information companies (CICs), it has been decided to put in place a comprehensive framework for strengthening and improving the efficacy of the grievance redress mechanism and customer service provided by the credit institutions (CIs) and CICs. For this purpose, the CICs have been brought under the aegis of the Reserve Bank Integrated Ombudsman Scheme (RB-IOS). It is also proposed to put in place the following measures: a compensation mechanism for delayed updation/rectification of credit information; a provision for SMS/ email alerts to customers when their credit information are accessed from CICs; a timeframe for ingestion of data received by CICs from Credit Institutions; and disclosures relating to number and nature of customer complaints received on the website of CICs.

Unified Payments Interface (UPI) is a robust payments platform supporting an array of features and handles 75% of the retail digital payments volume in India. RuPay credit cards were permitted to be linked to UPI. At present, UPI transactions are enabled between deposit accounts at banks, sometimes intermediated by pre-paid instruments including wallets. It is now proposed to expand the scope of UPI by enabling transfer to / from pre-sanctioned credit lines at banks, in addition to deposit accounts.

The next meeting of the MPC is scheduled during 06th – 08th June’23.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.