The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from October 4 -6, 2023.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

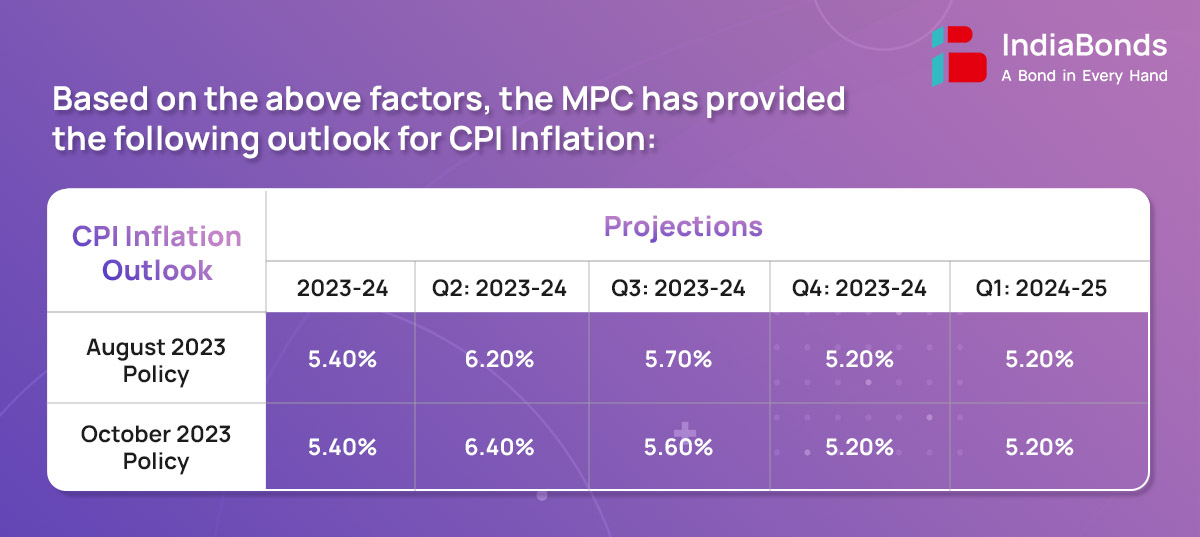

CPI headline inflation surged by 2.6% points to 7.4% in July due to spike in vegetable prices, before moderating somewhat in August to 6.8%. Fuel inflation edged up to 4.3% in August. Core inflation (i.e., CPI excluding food and fuel) softened to 4.9% during July-August 2023.

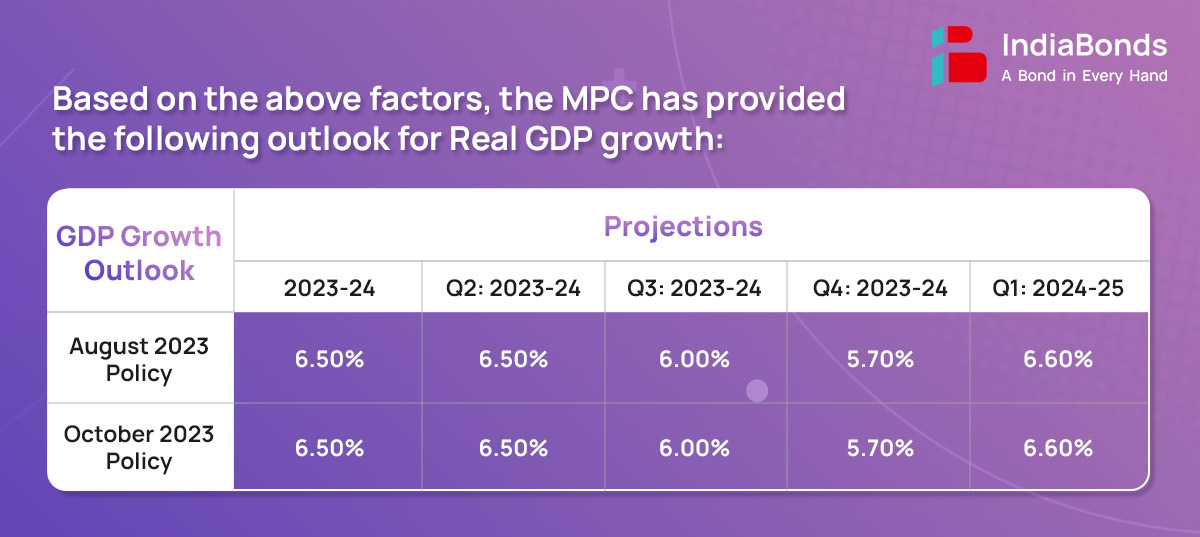

South-west monsoon rainfall recovered during September ended 6% below the long period average. The acreage under Kharif crops was 0.2% higher than a year ago. The index of industrial production rose by 5.7% in July core industries output expanded by 12.1% in August. Purchasing managers ‘indices (PMIs) and other high frequency indicators of the services sector exhibited healthy expansion in August-September. On the demand front, urban consumption is buoyant while rural demand is showing signs of revival. Investment activity is benefitting from public sector capex. Strong growth is seen in steel consumption, cement production as well as in imports and production of capital goods. Merchandise exports and non-oil non-gold import remained in contraction in August, although the pace of decline eased. Services exports improved in August.

The global economy is slowing under the impact of tight financial conditions, protracted geopolitical tensions and increasing geo-economics fragmentation. Global trade is contracting. Headline inflation is easing but rules above the target in major economies. While major central banks are signaling a peaking of their rate hike cycle, there are indications that the tight monetary policy stance could persist for longer than anticipated earlier. Sovereign bond yields have firmed up, the US dollar has appreciated, and global equity markets have corrected.

RBI has revised the extant regulations issued in June 2019 and put in place a comprehensive, risk-based framework for administration of financial benchmarks. The revised directions will provide greater assurance about the accuracy and integrity of financial benchmarks.

The key changes in the revised framework are: (i) withdrawal of the requirement to have a sponsor for the IDFs; (ii) allowing IDFs to finance toll-operate transfer (ToT) projects as direct lenders; (iii) permitting IDFs to raise funds through ECBs; and (iv) making tri-partite agreements optional for PPP projects.

UCBs have been permitted an extended glide path for achievement of PSL targets, beyond March 2023. With a view to incentivizing UCBs that have met the prescribed PSL targets as on March 31, 2023, RBI has decided to increase the monetary ceiling of gold loans that can be granted under the bullet repayment scheme from Rs. 2.00 lakh to Rs. 4.00 lakh for such UCBs who have met the overall PSL target and sub targets as on March 31, 2023.

RBI has decided to issue an omnibus framework for recognizing SROs for various Regulated Entities (REs) of the Reserve Bank. The omnibus SRO framework shall prescribe the broad objectives, functions, eligibility criteria, governance standards, etc., which will be common for all SROs, irrespective of the sector.

RBI has proposed to extend the PIDF Scheme by a further period of two years, i.e., upto December 31, 2025. Also, it is proposed to include beneficiaries of PM Vishwakarma Scheme in all centers under the PIDF Scheme. This decision to expand the targeted beneficiaries under the PIDF scheme will provide fillip to the Reserve Bank’s efforts towards promoting digital transactions at the grassroots level.

RBI introduced Card-on-File Tokenization (CoFT) in September 2021 and began implementation from October 1, 2022. RBI has now proposed to introduce CoF token creation facilities directly at the issuer bank level.

RBI has decided to harmonies internal Ombudsman framework and issue a consolidated Master Direction. The Master Direction shall bring uniformity in matters like timeline for escalation of complaints to IOs, exclusions, temporary absence of the Internal.

The next meeting of the MPC is scheduled during 6th – 8th Dec’23.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.