A notification buzzed, and both your mobile screen and your eyes lit up!

(Dear Customer,

Your Salary of Rs 1,82,336.00 is credited to you’re a/c no. XXXXX876 on 30-Nov-2023.)

Perhaps the only text message that brings a smile to your face and a sense of relief amidst a barrage of OTPs, EMI reminders, and spammy texts. But what does one do after receiving the salary?

Ideally, individuals should allocate their income to expenses, and these can be designated as ‘expense buckets’. These expenses can be further divided into ‘Essential expenses’ and ‘Non-essential expenses’. Essential expenses, as the name implies, are unavoidable costs such as groceries, rent, electricity, and EMIs. Non-essential expenses encompass discretionary spending on activities like shopping, dining out, travel, and movies—expenses not crucial for survival but related to lifestyle choices. Prior to addressing non-essential expenses, it is advisable to create another bucket, termed the ‘Investment Expenses’. This bucket is dedicated solely for investment purposes, utilizing the disposable income remaining after covering essential expenses. This allocation ensures that the available funds are directed towards investments. The issue arises when individuals lack control over non-essential expenses and forget to account for the investment bucket. Therefore, the recommended hierarchy should be established as follows:

Now, you might wonder, “Why should I consider an investment bucket when I am happy with saving through FDs?” Well, I am about to reveal a simple guru mantra that will help you grasp the significance of investing.

‘Always strive to ensure that your investments ultimately outperform inflation, i.e., generate inflation-adjusted returns‘

This simple yet powerful mantra eliminates the noise surrounding achieving a CAGR of 19-20% or maintaining an overly diversified portfolio. By concentrating exclusively on this principle, you can transform your approach to investments. Additionally, it’s worth noting that fixed deposits (FDs) cannot consistently generate inflation-adjusted returns.

Now, moving on to the investment bucket, we engage in this process to achieve our goals. These goals can encompass both short-term and long-term objectives, covering financial and non-financial aspects.

Anyone reading this in today’s environment understands the significance of having clearly defined goals. One of the primary steps in financial planning is identifying such financial goals. Once established, one needs to ask, “How can I achieve these goals?” The point here is that individuals should consistently endeavor to align their investments with their financial goals. Financial goals can be categorized as either short or long term; generally, if a goal is achievable in less than three years, it’s considered short-term, while anything beyond three years is termed as a long-term goal. Here’s a list of both short-term and long-term financial goals.

| Short-Term Goals | Long-Term Goals |

| Emergency Fund: Save 3 to 6 months’ worth of living expenses for unexpected situations. | Retirement Fund: Build a substantial fund to maintain your lifestyle after retirement. |

| Debt Repayment: Pay off high-interest debts like credit cards and personal loans. | Home Purchase: Save for a down payment on a house or apartment. |

| Vacation: Set aside money for a holiday or travel experience within the next year or two. | Children’s Education and Marriage: Save for your children’s college or university education and marriage. |

| Home Repairs: Budget for immediate repairs or renovations in your home. | Investment Portfolio: Build a diversified portfolio for long-term wealth growth. |

| Technology/Gadgets: Set aside funds for purchasing gadgets or tech devices. | Entrepreneurship: Save for starting your own business or investing in an entrepreneurial venture. |

| Special Events: Save for events like weddings, birthdays, or anniversaries. |

Remember, these goals may vary based on individual circumstances. However, having a mix of short-term and long-term financial goals is crucial for creating a balanced and comprehensive financial plan. Once you have identified and labeled these goals, it is essential to account for future financial objectives by investing in the right asset classes.

When dealing with short-term goals, it’s crucial to consider that the goal’s timeframe is brief. Therefore, one cannot afford to be lax with the amount invested or take excessive risks. Selecting the appropriate asset class becomes paramount; opting for equity, especially in a volatile market with capital risks, may not be prudent for short-term goals. In such instances, bonds emerge as the sensible choice. One of the primary advantages is the typically higher interest income compared to a regular savings account. Additionally, the ability to selectively choose bonds with near-future maturity aligns with short-term goals. Furthermore, in the event of emergencies, selling bonds does not incur penalties, unlike FDs.

Here’s how bonds can help retail investors attain their short-term financial goals, along with examples:

Bonds pay regular interest in the form of coupon payments to their holders, providing a predictable income stream. Retail investors can use this interest income to meet their short-term financial needs, such as paying bills, funding a vacation, or covering unexpected expenses.

Bonds are generally considered safer than stocks, especially government securities or AAA-rated bonds from stable corporations. They offer the assurance that the invested capital will be returned at maturity, making them ideal for investors who want to preserve their capital while earning some return.

Bonds can be more liquid than certain other investments, allowing investors to sell them on secondary markets before maturity. This liquidity provides retail investors with the flexibility to access funds quickly, helping them respond to immediate financial needs.

Including bonds in an investment portfolio can reduce overall risk, especially in the short term. During stock market downturns, bonds often provide stability and can offset losses in a diversified portfolio.

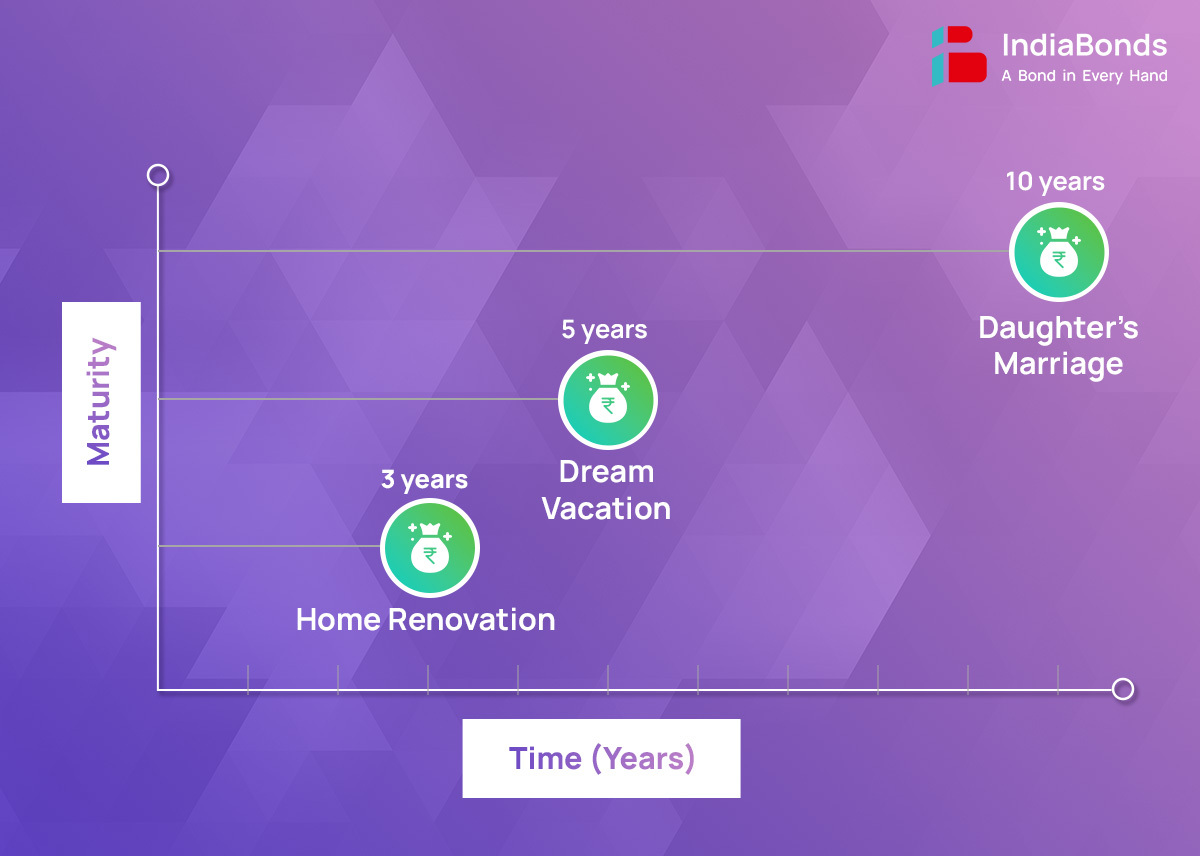

In the infographic below, we can observe how individuals can invest in bonds with varying maturities to achieve their financial objectives:

Bonds can play a crucial role in aiding retail investors in attaining their short-term financial objectives by delivering regular income, preserving capital, ensuring liquidity, managing risk, and even providing potential tax advantages. Nevertheless, it is crucial for investors to thoughtfully assess their risk tolerance, investment goals, and the specific terms of the bonds they intend to invest in before making any financial decisions. Practicing financial discipline involves managing finances responsibly, including the creation of budgets, consistent saving, wise debt management, informed investment decisions, future planning, avoidance of impulsive spending, and ongoing education about personal finance. Cultivating financial discipline empowers individuals to reach their goals, accumulate wealth, and secure their financial future.

A. Bonds can be valuable tools for retail investors looking to achieve short-term financial goals. Unlike stocks, which can be volatile in the short term, one dip and it could wipe off your entire savings and it would also be difficult to recover that loss. Bond investments can offer a stable source of income and help preserve capital, making them valuable for meeting short-term financial goals.

A. Considerations should include the investor’s risk tolerance, investment horizon, and the current economic environment. Understanding the terms and conditions of the bonds is also crucial.

A. Yes, many bonds can be sold in the secondary market before maturity, providing investors with the flexibility to access funds for short-term needs. Investors may focus on short-term goals for bond investment, aiming to achieve specific financial objectives within a relatively brief timeframe.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.