Blogs

What are State Development Loans – Meaning, Features and Benefits

In one of the previous articles, we learned about how the government issues g-secs to fulfill its fiscal requirements. Similarly, state governments issue bonds, commonly known as State Development Loans (SDLs), to meet their budgetary needs. State development loans are debt instruments issued by state governments in India to fund its developmental activities. In the […]

Difference between Tax free bonds and Tax Savings Bonds

In this world nothing can be said to be certain, except death and taxes. –Benjamin Franklin This quote reflects the inevitability of these two things in life. Death is inevitable for all living beings and taxes are a necessary part of modern society. Taxes are a way for the government to collect revenue, which is […]

Bonds vs Bond Funds

Investors are perplexed by the most recent amendments in the bond market. Following the elimination of the indexation benefits for bond funds, individuals may find themselves uncertain about where to invest their money, specifically in bonds or bond funds. However, do not fret, as this article will provide valuable insights into the age-old debate of […]

Difference Between Zero Coupon Bonds and Deep Discount Bonds

The fixed deposit represented the quintessential example of the Indian investor’s behavior. It meets all the requirements that an average Indian seeks – safety, predictable returns and the assurance of receiving their money back on time. However, in the early 1990s, deep discount bonds emerged as a challenge to the established order. Investors were attracted […]

Sovereign Gold Bond vs Digital Gold

In the past decade, the digital revolution in India has caused a stir. We no longer only use technology to order food, clothing and appliances, but can also purchase cars and jewellery online. Furthermore, the wealth-tech sector has seen the emergence of numerous online players offering financial products and services. Gold, which is highly valued […]

Bonds vs Equities or Stocks

What is the most common question that every financial advisor receives? What is the most discussed topic in every investment forum, financial planning and investment advice literature? And what is the all-time, go-to topic for a “fin-fluencer” to create content on? Bonds vs Equities Bonds and stocks are the two most talked-about asset classes in […]

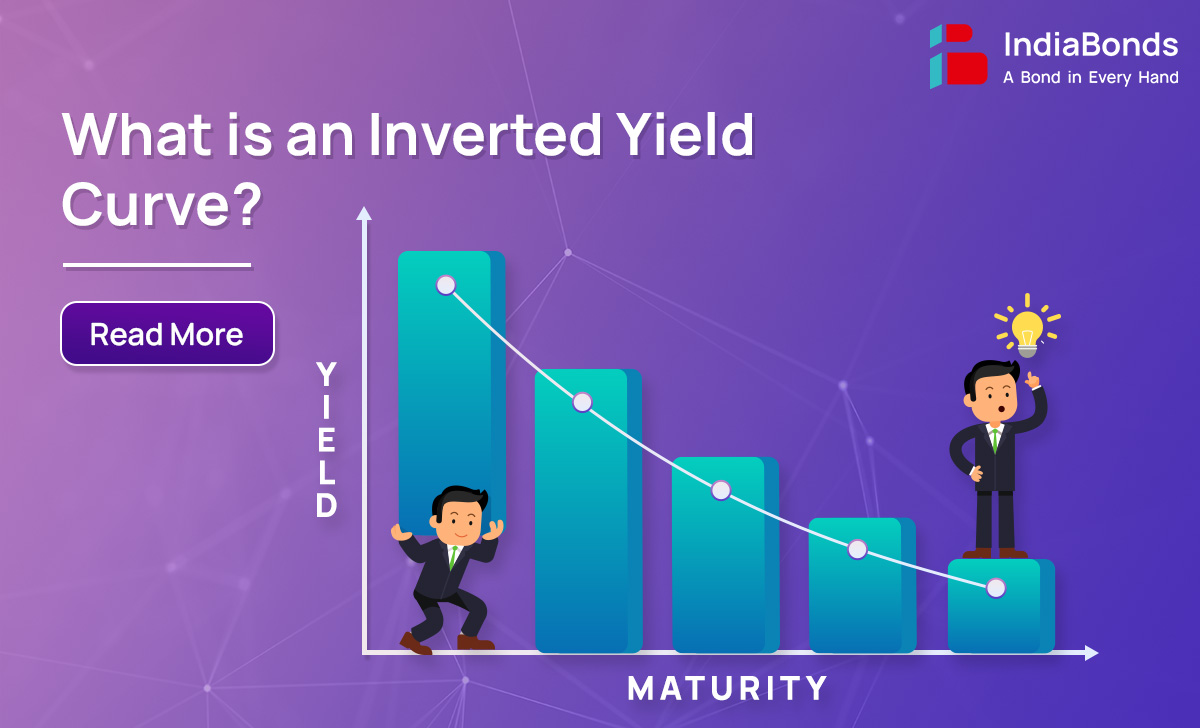

What is the Inverted Yield Curve and why it matters

In the world of bond investing, the term “yield” is synonymous with “return.” When referring to the “yield” of a 10-year Government Security (G-Sec), it communicates the 10-year return on that particular bond. The yield curve is a graph that shows the relationship between the yields and the maturity dates of a series of bonds. […]

What is G-Sec and State Guaranteed Bond?

Generally, in a developing economy, the expenditure of the central government surpasses its earnings, resulting in an outflow of funds that exceeds the inflow, which is known as a fiscal deficit. To address this deficit, the central government can resort to two measures: printing notes or issuing government securities (borrowing money). However, consistently printing notes […]

Bonds vs Fixed Deposits

In the world of fixed income securities, Bonds and Fixed Deposits (FDs) are two dominant players, each with its own advantages and limitations. While FDs are widely used, bonds remain largely overlooked. In 2017, SEBI conducted a survey* to study investment patterns in households, which revealed that over 95% of households, preferred FDs as their […]