For new investors, the process of investment can be daunting. With all the attractive details pertaining to the business and the potential returns on the investment, how do you gauge whether the investment will actually reap you any benefits?

Or, simply put, is the option worth investing in considering your objectives?

Bonds are low-risk investment instruments that offer stable returns to their holders. However, with the growing number of bond instruments, how do you choose the right one to balance your portfolio risk?

What if you want a professional’s input regarding the safety and security of these investments?

Well, you can! This point is where a bond’s ratings come into the picture. It defines an issuer’s credit quality and financial stability. This article will answer what is a bond rating and how bonds are rated.

An applicant’s credit score is a primary factor a lender considers when considering a loan application. A higher credit score increases the likelihood of loan approval.

Similarly, bond ratings are a great way to identify a bond issuer’s creditworthiness. It shows whether the issuer can comply with the bond contract’s terms. In other words, whether the bond issuer can pay back the principal and interest amount on due dates.

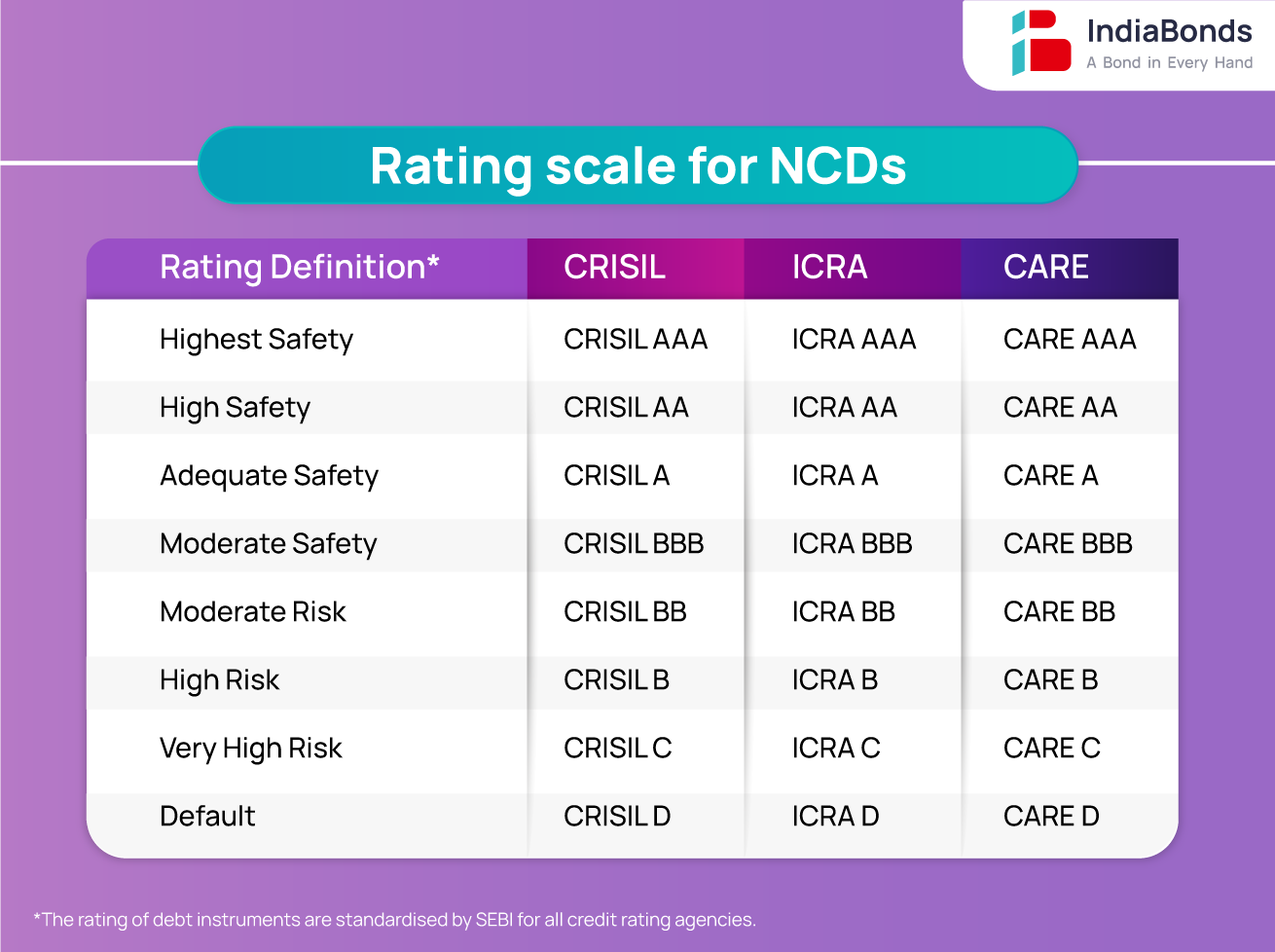

The higher the bond credit rating, the better the issuer’s financial strength. A bond rating ranges from AAA to D, with AAA being the highest and D being the lowest denoting default by the issuer. CRISIL, Care, and ICRA are three major credit agencies that issue these credit ratings to the bonds in India.

Credit agencies issue bond ratings after considering multiple factors. Listed below are some metrics which go to explain how bonds are rated.

Balance sheets and cash flow statements show how quickly an issuer pays off its debts and uses its cash. A lower debt liability means better liquidity and financial position, and thus, the better the bond rating.

Companies cannot avoid the political and economic conditions of the country. However, you can analyze its vulnerability to these conditions. The company’s bond rating is determined by its vulnerability to adverse political conditions. The higher the company’s vulnerability, the lower the bond rating.

Credit rating for bonds is also significantly affected by the state of the industry they are in. If the industry overall sees an uptick in terms of revenue and profits, the credit ratings are bound to improve. However, if the opposite were to occur and an industry were to be in a downturn, the credit ratings may worsen.

A company’s growth projections affect the status of potential investments. A company with high growth projections is more likely to attract investments. As such, the better the growth projections of the company, the better the bond credit rating.

Purchasing a company bond makes you the company’s creditor. Therefore, the company is responsible for paying the principal and interest on time. If they default, the bond rating will be affected.

It is important to keep track of rating changes on bonds you own. These can get affected by news from the company on its quarterly financial results. Positive ratings are triggered by improvements in the company, while negative ones could involve wrong reasons such as scandal, fraud, insider dealing, etc.

Credit ratings are vital as they provide investors with a measure of the risk associated with investing in a bond. They are indicative of the likelihood that the issuer will be able to meet its financial obligations. By understanding the bond credit ratings explained, investors can make more informed decisions and better assess the risk-return profile of their investments.

Depending on the credit agency ratings, you can classify the bonds into investment-grade and non-investment-grade bonds.

An investment grade bond, rated between AAA and BBB, is considered to be a safer and more stable investment.

Conversely, Non-investment-grade or high-yield bonds carry a higher degree of risk, which is why they have lower credit ratings, such as BB+ to D. Since these bonds carry additional risk, they come with high yields. Usually, small businesses, startups, or companies with weaker competitive positions or lack operational diversification receive these bond ratings.

Credit agencies periodically evaluate the bond ratings. If an investment grade loses its credit quality, it moves to a non-investment grade rating. Then, it is also known as fallen angel bonds.

Bond credit ratings are a basic and easy way to verify the quality and stability of the bond. As part of the primary checks before investing, check the bond rating to understand the issuer’s creditworthiness. However, it is important to remember that it’s one of the key parameters to consider while investing but not the only parameter.

Verify bond credit ratings for any bond by browsing through IndiaBonds’ Bond Directory, where you can access detailed bond information. Happy Investing!

A. Credit rating in bonds assesses the creditworthiness of an issuer, indicating the risk associated with the bond and its ability to meet payment obligations.

A. Bond market credit ratings evaluate the safety of bonds, rated by agencies influencing the interest rates and investment appeal.

A. The best credit rating for bonds is ‘AAA’, signifying the highest level of creditworthiness and the lowest risk of default.

A. The credit score of a bond is a rating or grade given to a bond issuer by a credit rating agency. This score indicates the likelihood that the issuer will be able to repay their debt obligations. A higher rating suggests a lower risk of default, thereby implying that the issuer is more likely to meet its financial commitments on time and in full.

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.