The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from October 7-9, 2024.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

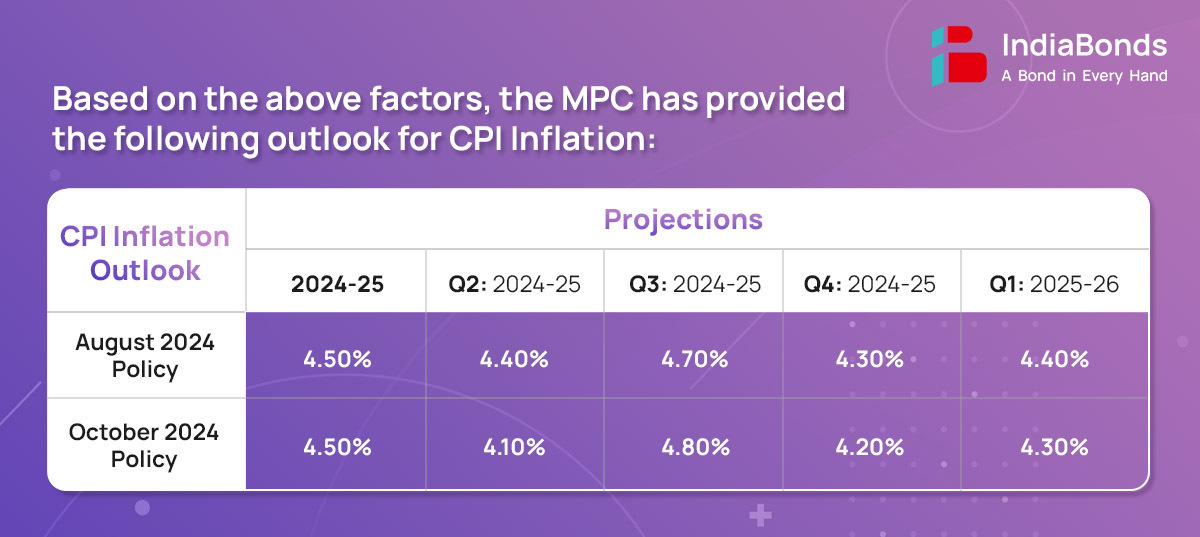

CPI headline inflation softened significantly in July and August with favorable base effect playing a major role in July (base effect of 2.9%). Also the food inflation experienced a certain degree of correction during these two months (average of 5.2% from an average of 8.0% during the previous 8 months). Additionally, fuel group deepened deflation on account of softening electricity and LPG prices, while core inflation including the service inflation edged up. However, September CPI may witness jump due to fading of base effect (base effect of 1.1%) supported by pick up in food price momentum due to supply side issues.

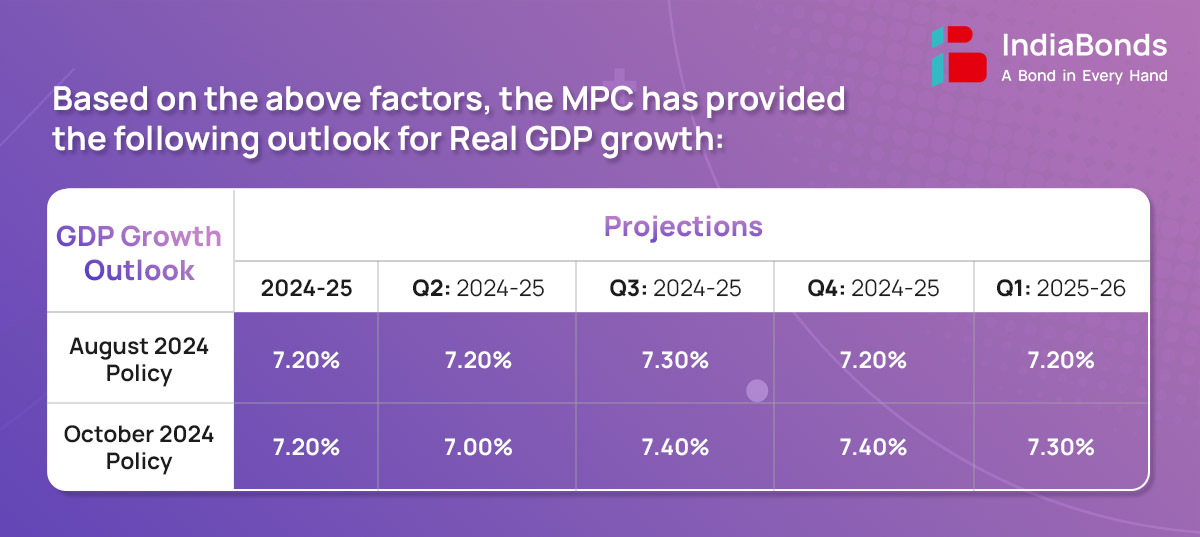

During 2024-25 so far, domestic economic activity has remained resilient, supported by a revival in private consumption (with a 7-quarter high of 7.4% in Q1:2024-25) and improvement in investment, as its share in GDP reached the highest level since 2012-13. On the supply side, gross value added (GVA) expanded by 6.8% surpassing GDP growth, driven by strong industrial and services sector activities. However, the government expenditure contracted. Also the eight core industries output fell by 1.8% in August on a high base. Both manufacturing and services PMI’s remained elevated. Private investment continues to grow supported by expansion in in non-food bank credit, higher capacity utilization, etc. FPI flows have reversed from net outflows of USD 4.2 billion in April-May 2024 to a net inflow of USD 19.2 billion during June-October (as of October 7, 2024).

The global economy has remained resilient, despite ongoing risks from escalating geopolitical tensions, geo-economic fragmentation, financial market volatility, and high public debt. While manufacturing is slowing down, the services sector continues to perform well. With easing in inflation and growing divergence in inflation-growth dynamics across countries, various advanced economies including U.S. and emerging market economies have started lowering their policy rates.

The Reserve Bank has taken several measures over the years to safeguard consumer’s interest. As part of these measures, Banks and NBFCs are not permitted to levy foreclosure charges/ pre-payment penalties on any floating rate term loan sanctioned to individual borrowers for purposes, other than business. It is now proposed to broaden the scope of these guidelines to include loans to Micro and Small Enterprises (MSEs). A draft circular in this regard shall be issued for public consultation.

The Reserve Bank has undertaken several initiatives in recent years to strengthen the Urban Co-operative Banking (UCB) Sector. Such initiatives include issuance of regulatory guidelines in 2022 for issue and regulation of share capital and securities by UCBs. To provide more flexibility and avenues for UCBs to raise capital, a Discussion Paper on Capital Raising Avenues for UCBs will be issued for feedback and suggestions from stakeholders.

Climate change is emerging as a significant risk to the financial system world over. This makes it necessary for regulated entities to undertake robust climate risk assessment, which is sometimes hindered by gaps in high quality climate related data. To bridge these data gaps, the Reserve Bank proposes to create a data repository, namely, the Reserve Bank – Climate Risk Information System (RB-CRIS).

UPI has transformed India’s financial landscape by making digital payments accessible and inclusive through continuous innovation and adaptation. To further encourage wider adoption of UPI and make it more inclusive, it has been decided to (i) enhance the per-transaction limit in UPI123Pay from Rs.5,000 to Rs.10,000; and (ii) increase the UPI Lite wallet limit from Rs.2,000 to Rs.5,000 and per-transaction limit from Rs.500 to Rs.1,000.

At present, UPI and Immediate Payment Service (IMPS) provide a facility for the remitter of funds to verify the name of the receiver (beneficiary) before executing a payment transaction. It is now proposed to introduce such a facility for the Real Time Gross Settlement System (RTGS) and the National Electronic Funds Transfer (NEFT) system. This facility will enable the remitter to verify the name of the account holder before effecting funds transfer to him/her through RTGS or NEFT. This will also reduce the possibility of wrong credits and frauds.

The next meeting of the MPC is scheduled during December 4 to 6, 2024

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.