June’24 RBI Monetary Policy Highlights

The RBI’s Monetary Policy Committee (MPC) conducted its monetary policy meeting from June 5-7, 2024.

On the basis of an assessment of the evolving macroeconomic situation, the Monetary Policy Committee (MPC) made the following announcements:

- Keep the policy repo rate unchanged at 6.50% by a majority of 4 out of 6, consequently the standing deposit facility is unchanged at 6.25%.

- Accordingly, the Marginal Standing Facility (MSF) rate and the Bank Rate remain unchanged at 6.75%

- The reverse repo rate under the LAF stands unchanged at 3.35%.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns to the target, while supporting growth.

- These decisions are in consonance with the objective of achieving the medium term target for consumer price index (CPI) inflation of 4% within a band of +/- 2%, while supporting growth.

Part A: RBI’s Policy decision Rationale:

1. Inflation

CPI headline inflation softened further during March-April, though persisting food inflation pressures offset the gains of disinflation in core and deflation in the fuel groups. Despite some moderation, pulses and vegetables inflation remained firmly in double digits. Vegetable prices are experiencing a summer uptick following a shallow winter season correction. The deflationary trend in fuel was driven primarily by the LPG price cuts in early March. Core inflation softened for the 11th consecutive month since June 2023. Services inflation moderated to a historic low and goods inflation remained contained.

The MPC expects CPI outlook to be shaped by several factors such as:

- Normal monsoon, could lead to softening of food inflation pressures over the course of the year.

- Pressure from input costs have started to edge up and early results from enterprises surveyed by the Reserve Bank expect selling prices to remain firm.

- Volatility in crude oil prices and financial markets along with firming up of non-energy commodity prices pose upside risks to inflation.

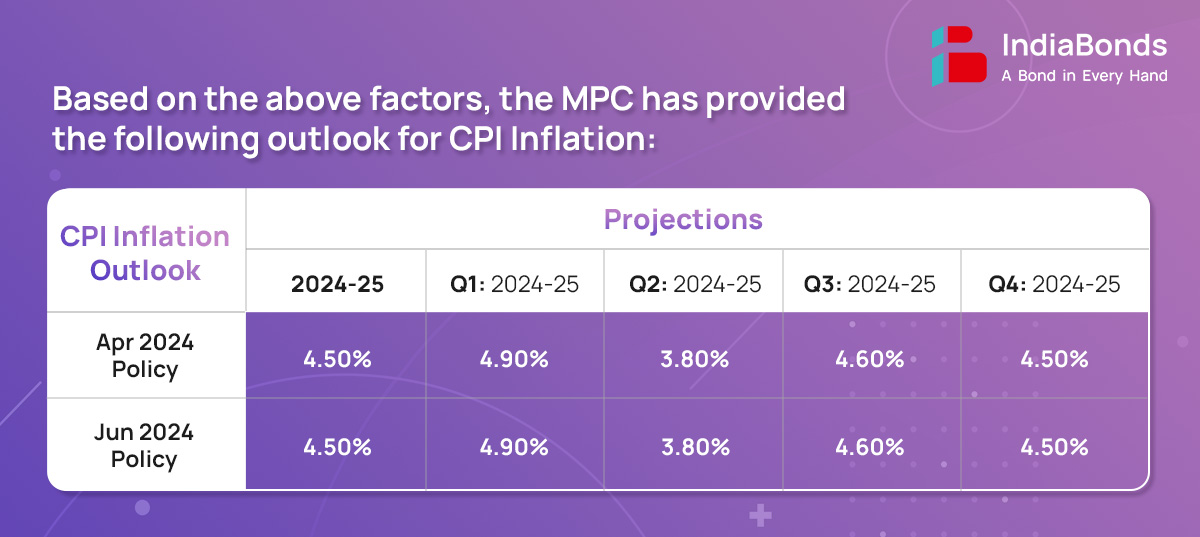

- Assuming a normal monsoon, CPI inflation for FY24-25 is projected at 4.50% with Q1 at 4.90%; Q2 at 3.80%; Q3 at 4.60%; and Q4 at 4.50%.

2. Growth

The provisional estimates released by the National Statistical Office (NSO) placed India’s real GDP growth at 8.20% in FY23 – 24. During 2024-25 so far, domestic economic activity has maintained resilience. Manufacturing activity continues to gain ground on the back of strengthening domestic demand. The eight core industries posted healthy growth in April 2024. Manufacturing PMI in April-May 2024 has showed continued resilience. Services sector maintained buoyancy as evident from available high frequency indicators. PMI services stood strong at 60.2 in May 2024 indicating continued and robust expansion in activity.

The MPC expects real GDP to be based on the following factors:

- Private consumption, the mainstay of aggregate demand, is recovering, with steady discretionary spending in urban areas.

- Investment activity continues to gain traction on the back of ongoing expansion in non-food bank credit.

- Merchandise exports expanded in April with improving global demand. Services exports and imports rebounded and posted a strong growth in April 2024.

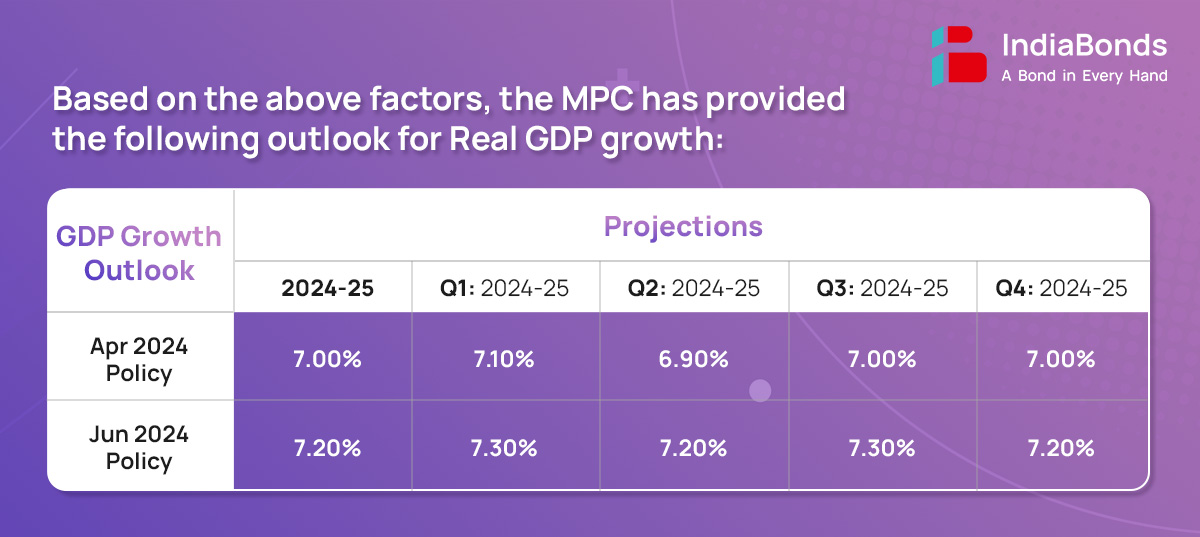

- Taking all these factors into consideration, real GDP growth for FY24-25 is projected at 7.20% with Q1 at 7.30%; Q2 at 7.20%; Q3 at 7.30%; and Q4 at 7.20%.

3. Liquidity

- During the current financial year so far, system liquidity transited from surplus to deficit conditions and back to surplus in early June.

- In consonance with the commitment made in the April policy statement of remaining nimble and flexible in liquidity management and in view of the shifting liquidity dynamics.

- The Reserve Bank mopped up surplus liquidity through variable rate reverse repo (VRRR) auctions during the first half of April, while injecting liquidity through variable rate repo (VRR) operations in the later part of April and in May.

- Banks’ recourse to the marginal standing facility (MSF) under the liquidity adjustment facility (LAF) remained low during 2024-25 so far.

4. Global Economy

Global economic activity is rebalancing and is expected to grow at a stable pace in 2024. Inflation has been moderating unevenly, with services inflation staying elevated and slowing progress towards targets. Uncertainty on the pace and timing of policy pivots by central banks is keeping financial markets volatile. Non-energy commodity prices have firmed up, while the US dollar and bond yields are exhibiting two-way movement with spillovers to emerging market currencies. Gold prices have surged to record highs on safe haven demand.

Part B: Key Statements on Developmental and Regulatory Policies:

1. Review of Limit of Bulk Deposits in Banks

RBI has revised the definition of bulk deposits as ‘Single Rupee term deposit of Rs.3 crore and above’ for SCBs (excluding RRBs) and SFBs. Further, it is also proposed to define the bulk deposit limit for Local Area Banks as ‘Single Rupee term deposits of Rs.1 crore and above’, as applicable in case of RRBs.

2. Rationalisation of Guidelines for Export and Import of Goods and Services under Foreign Exchange Management Act (FEMA), 1999

RBI has decided to introduce a mobile application of the Retail Direct portal. The move is expected to further improve ease of access and the app will enable investors to buy and sell instruments on the go, at their convenience. The app will be available for use shortly.

3. Setting up a Digital Payments Intelligence Platform

The RBI has taken a number of measures over the years to deepen digital payments while ensuring their safety and security. Growing instances of digital payment frauds, however, highlight the need for a system-wide approach to prevent and mitigate such frauds. It is, therefore, proposed to establish a Digital Payments Intelligence Platform for network level intelligence and real-time data sharing across the digital payments’ ecosystem.

4. Inclusion of Recurring Payments with Auto-Replenishment Facility under the e-mandate Framework

RBI has proposed to include payments, such as replenishment of balances in Fastag, National Common Mobility Card (NCMC), etc. which are recurring in nature but without any fixed periodicity, in the e-mandate framework.

5. Introduction of Auto-Replenishment of UPI Lite Wallet – Inclusion under the e-mandate Framework

The facility of cash deposit is presently available only through use of debit cards. Given the popularity and acceptance of UPI, as also the benefits seen from the availability of UPI for card-less cash withdrawal at ATMs, it is now proposed to facilitate cash deposit facility through use of UPI.

6. HARBINGER 2024 – Innovation for Transformation

The RBI has taken several pioneering initiatives in recent years to encourage innovation in the Fintech sector. One such key initiative is the global hackathon: ‘HaRBInger – Innovation for Transformation’. The first two editions of the hackathon were completed in the year FY22-23, respectively. The 3rd of the global hackathon, with two themes, namely ‘Zero Financial Frauds’ and ‘Being Divyang Friendly’ will be launched shortly.

The next meeting of the MPC is scheduled during August 6 to 8, 2024

Disclaimer: Investments in debt securities/ municipal debt securities/ securitised debt instruments are subject to risks including delay and/ or default in payment. Read all the offer related documents carefully.